- Webinars

The Potential of Drop-In, Zero-Carbon Fuels

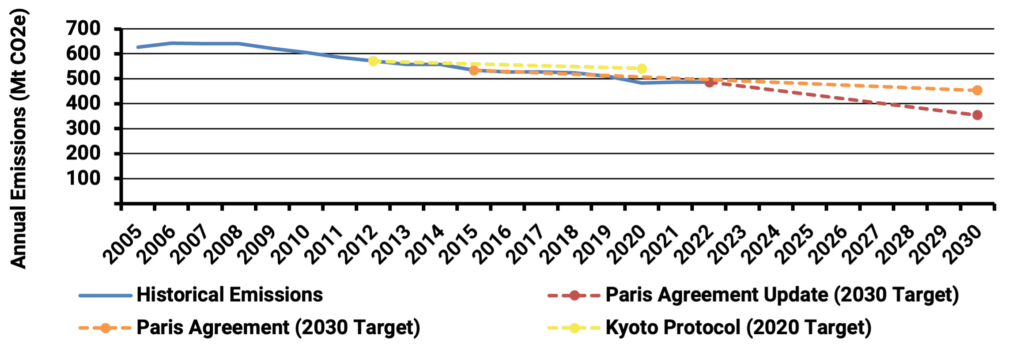

The Paris Accord requires signatories to increase their targets when it becomes cost effective to do so.

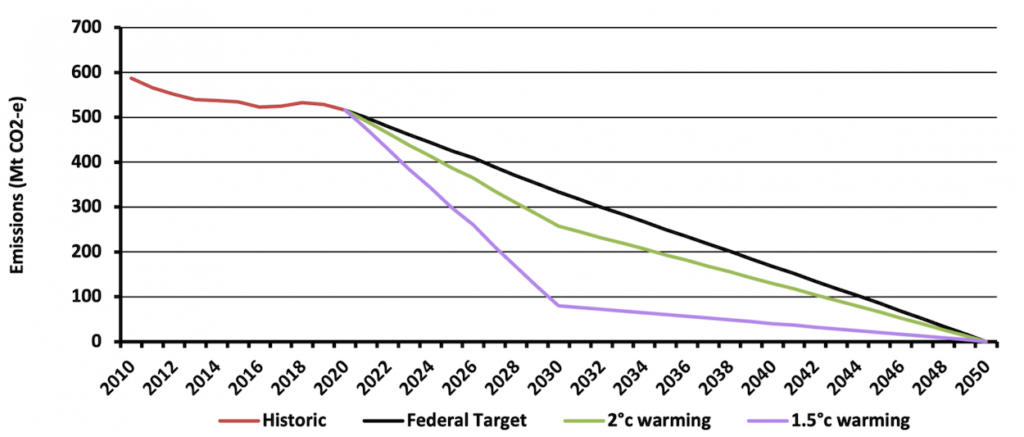

In 2022, Australia updated its commitment to achieve net zero by 2050, as shown in the figure below, with many states aiming for a more stringent target, including Victoria and the ACT committing to achieving net zero by 2045.

In setting its targets, Australia, like its international peers, must balance the costs and risks of more stringent targets with their potential global and local benefits like lower emissions and associated healthcare costs. Identifying lower cost and risk options enables the adoption of those targets at the state, Federal, and international levels.

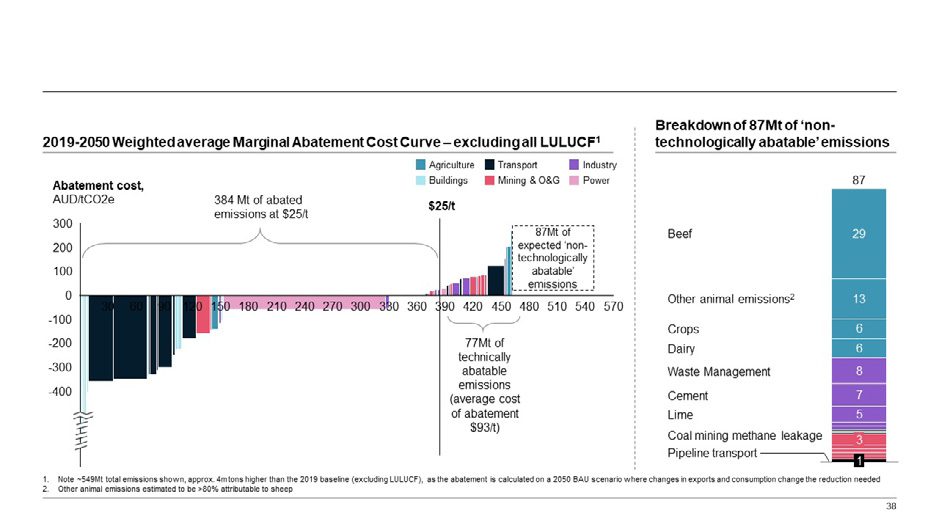

Recently completed work underpinning Australia’s updated targets shows the relative costs by potential abatement option below. It calls out key sources of ‘non-technologically abatable’ emissions, which cover agriculture, waste management, construction, and mining sectors. The current plan is to use net negative options like LULUCF to offset these and options >$25/ton.

Listen or click through at your own pace

Drop-In Zero-Carbon Fuels

Australia’s 2021 CO2 reduction strategy is technology-led, with a heavy focus on the scale-up and cost reduction of green hydrogen, changes in land use, and Carbon Capture and Sequestration (CCS). Energeia is planning future pieces to focus on each of these sectors. Stay tuned!

While the Commonwealth and state governments have committed billions of dollars in their latest policy pronouncements, it remains unclear whether green hydrogen, the costs of CCS and LULUCF, and performance will fall in line with forecasts or whether there may be cheaper, lower-risk alternatives – especially in the short and medium term.

Overseas, leading jurisdictions, including California, are looking at ‘drop-in,’ zero-carbon biofuels as a potential, low-risk solution for managing critical risks to meeting CO2 reduction targets in the near term.

Key drivers for looking at ‘drop-in’ biofuels as a near-term strategy for achieving relatively aggressive CO2 reductions include:

Addresses a wide range of existing fuels, including natural gas (methane), diesel, propane, LPG, and jet fuel (kerosene)

Enables use of existing downstream infrastructure for longer, e.g., pipelines, vehicles, appliances

Addresses hard-to-abate sectors highlighted in Commonwealth analyses, removing methane and other fugitive emissions from animal and other organic waste streams

Well-established, mature conversion technology, but cost reduction innovations still possible

Supports agriculture and existing infrastructure and supply chains, so politically popular

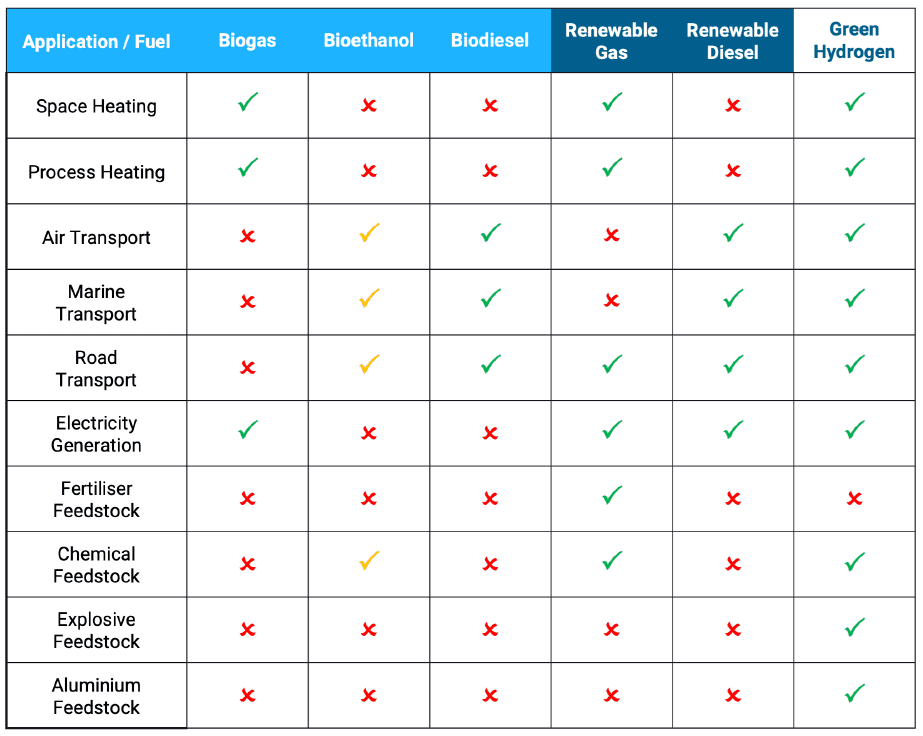

Key sectors that Australia’s biofuels could potentially address in the near-to-medium term, as highlighted in the table below, in comparison to other types of biofuels and Green Hydrogen.

Key Biofuel Applications

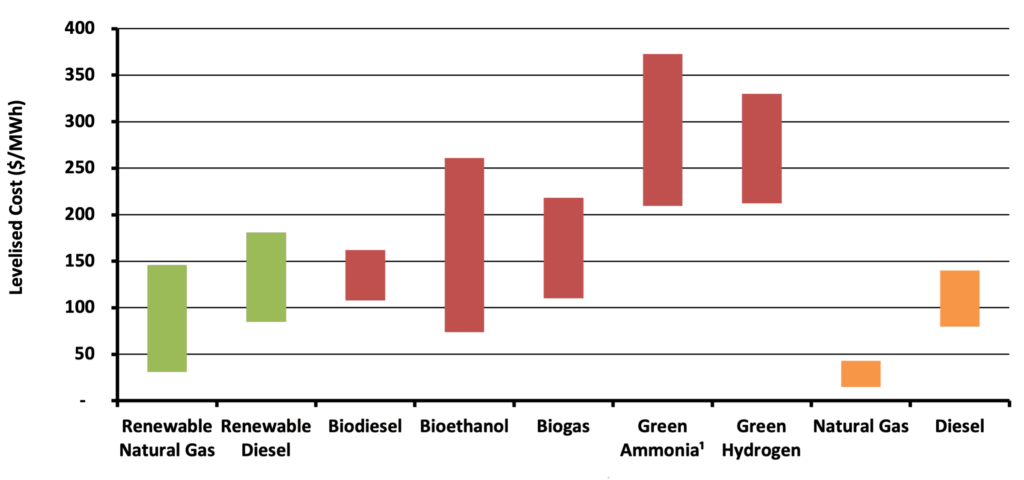

As shown in the following figure, the estimated cost of drop-in biofuels is already competitive with fossil fuels. The critical questions for Australia revolve around prices and capacity. How will prices evolve, and how much capacity will be available at what cost?

Current Levelised Costs of Fuel-by-Fuel Type in Australia

Answering these questions will require significant investment in primary and secondary research and analytics, on top of additional investment in pilots, trials, and scaling up industry capacity. Energeia’s experience developing long-term cost forecasts in the U.S. may provide some initial insights.

Based on our work estimating the demand, supply, and pricing of zero-carbon fuels in the U.S. and California specifically, we have developed an estimate of the potential pricing in Australia, assuming comparable relative investments in the Australian industry, reported below.

Forecast Fuel Production Costs

Our analysis suggests that while drop-in replacements are higher cost than fossil fuels, they are, and will remain, cheaper than other options, including Green Hydrogen.

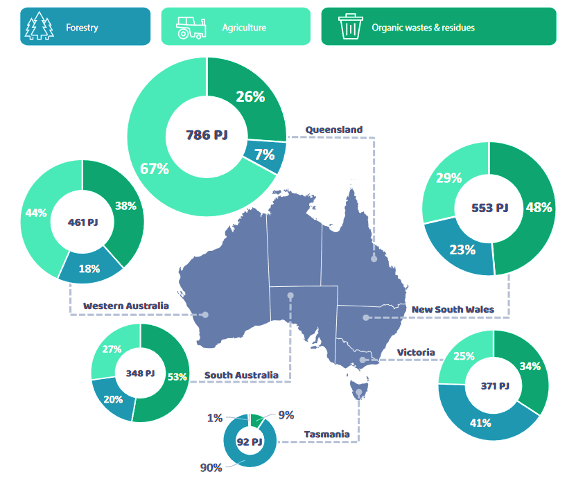

According to work completed on behalf of the Australian Renewable Energy Agency (ARENA), Australia’s bioenergy technical potential is estimated to be over 2,600 PJ per year, which would represent

40% of Australia’s current energy supply

Ten times its current bioenergy production

What is not well understood is the relative cost of each feedstock source of supply and how it varies by quantity – i.e., a supply cost curve.

Energeia’s view is the drop-in biofuels could potentially help Australia deliver more CO2 reductions earlier, at lower risk. However, achieving their potential will require the following:

- Investment in research (including industry datasets), development, and demonstration

- A support scheme akin to California’s LCFS system to appropriately credit their GHG impacts

We expect that even a fraction of the funding earmarked for Green Hydrogen could go a long way to unlocking the potential of these zero-carbon fuels to help meet the country’s zero-carbon transition.

For more detailed information regarding the key challenges of analysing and optimising drop-in, zero-carbon biofuels, best practice methods, and insight into their implementation and implications, please see Energeia’s webinar and associated materials.

For more information or to discuss your specific needs, please request a meeting with our team.

You may also like

Bridging the Skills Gap: Workforces for Electrification

Australia’s clean energy transition demands a skilled workforce. Energeia’s analysis reveals urgent needs, strategic solutions, and policy pathways to bridge the electrification skills gap and

Unlocking the Potential of Consumer Energy Resources

The AEMC partnered with Energeia to explore how flexible Consumer Energy Resources (CER), like solar, batteries, electric vehicles, and smart appliances, can reduce costs and

Optimizing DC Fast Charging Tariff Structures

Energy Queensland collaborated with Energeia to address financial barriers in EV charging infrastructure, focusing on high network tariffs and demand charges. The study evaluated alternative