- Webinars

Overcoming the Grid’s CER Hosting Capacity Barriers

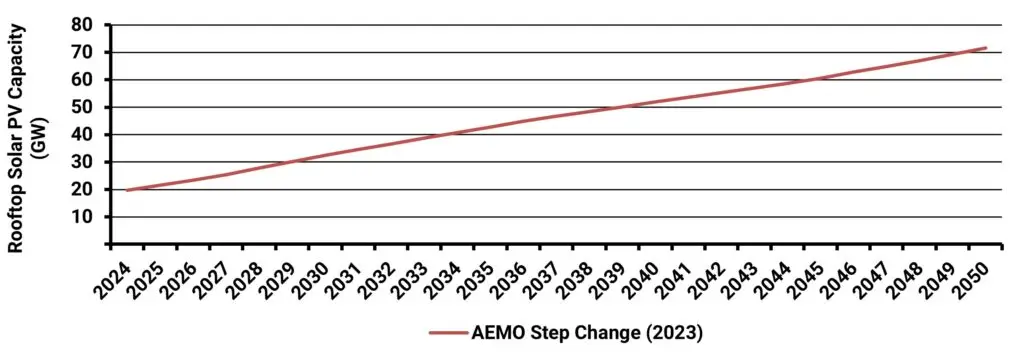

World-leading rooftop solar PV adoption rates and rising system sizes mean Australian grids are increasingly limited in their ability to host additional systems. Even so, the Australian Energy Market Operator (AEMO) is forecasting a 2.5 increase in rooftop solar PV (PV) by 2050. Key to connecting this PV efficiently and effectively will be implementing least cost solutions in a timely fashion. It is no accident that Australia has been pioneering some of the world’s leading solar PV hosting technology. Chief among them are dynamic operating envelopes (DOEs), which can remove hosting capacity barriers like static connection limits, and minimize curtailment.

The following sections summarize the key drivers of PV adoption in Australia and outlook to 2050, and the best options for connecting them over the period, with a focus on DOEs, and how they can be configured to deliver the greatest level of PV hosting at the lowest costs, and what key issues need to be addressed to unlock the grid’s full potential.

Australia’s Building Emissions and Electrification Potential

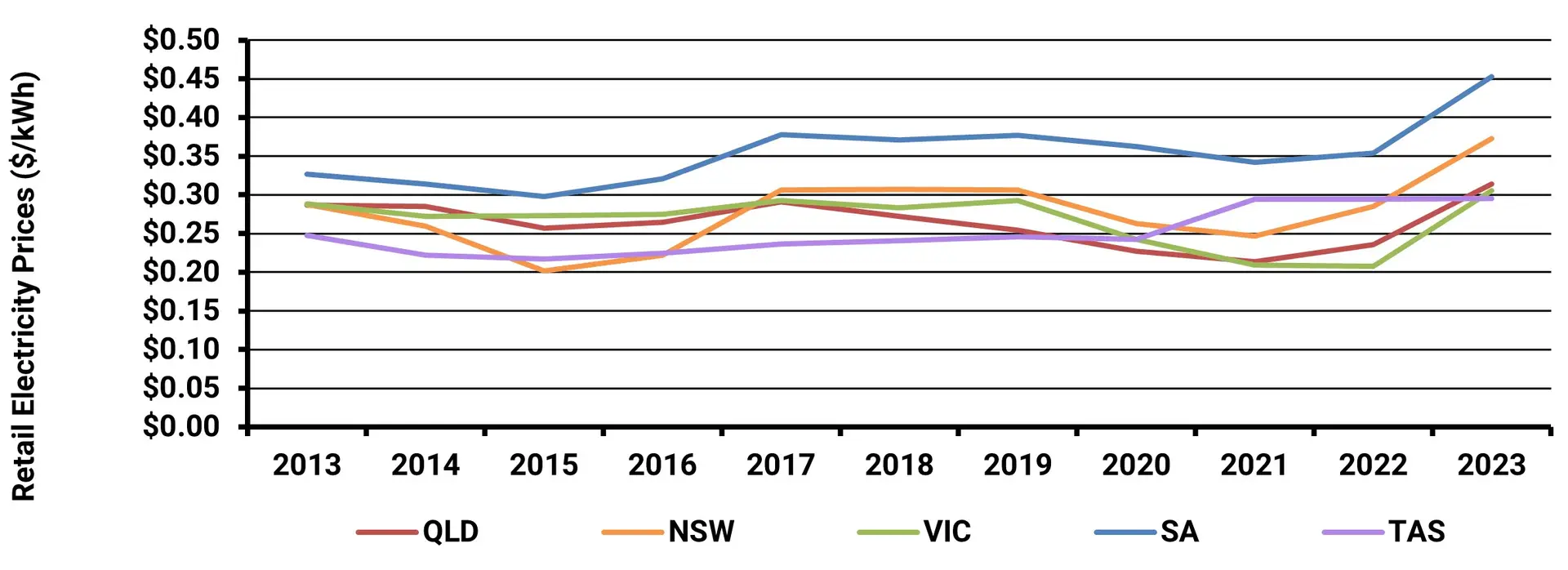

Retail electricity prices have been largely flat over the last 10 years, while PV prices have fallen by around 50% over the same period on a levelized basis as shown in the figure below. Increasing PV system size leads to relatively more exports, which do not receive the same value, depending on the Feed-in Tariff (FiT).

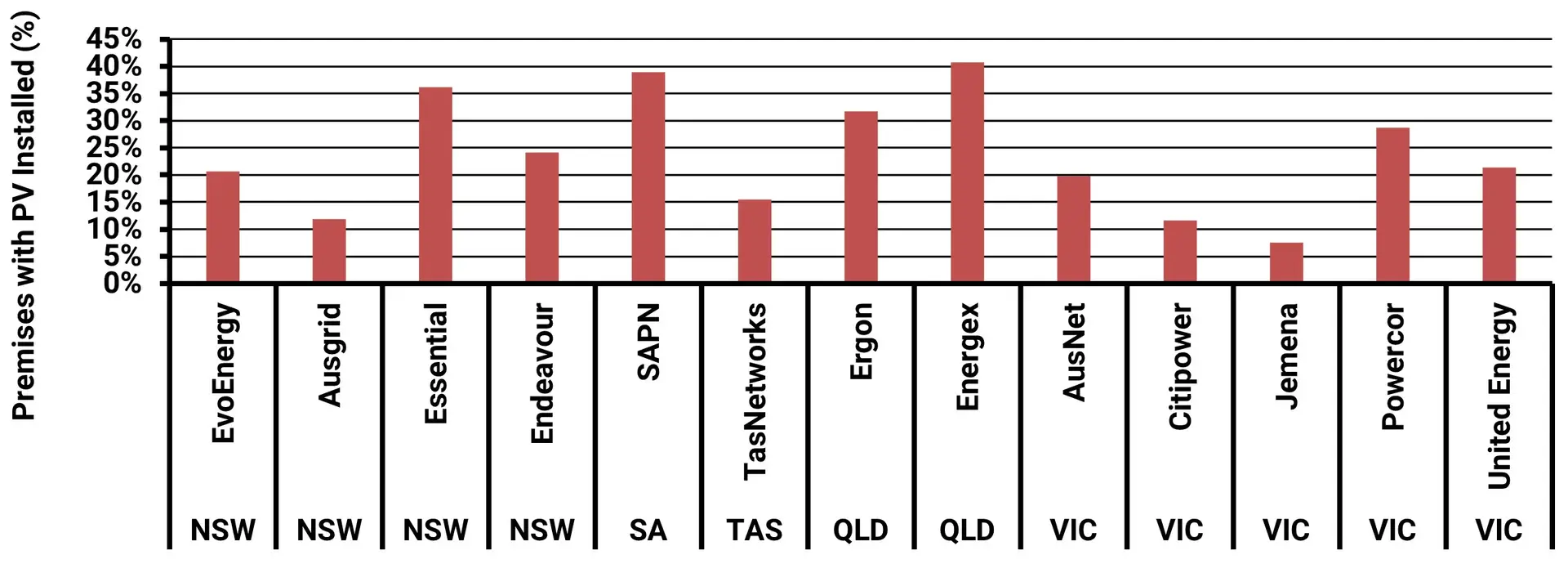

Driven by the above economic dynamics, Australian’s that can, i.e. owner-occupiers of single family dwellings with access to the sun, have flocked to PV, reaching over 60% of all premises in Energex’s network. Some of the networks with relatively low levels of adoption, like Citipower, Jemena and TasNetworks, have relatively fewer single family dwellings or sunshine.

It is worth noting that the highest penetration in the US is in Hawaii, which was around 36% of single family dwellings in 2021 on the island of Oahu.

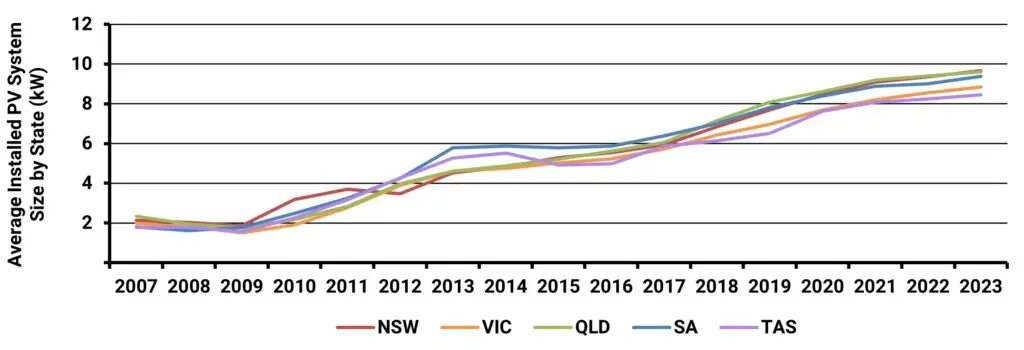

In addition to rising levels of penetration, the average system size has also been rising as panel efficiency has risen. Australian’s are looking to put as much capacity as possible on their roofs, aiming to maximize minimum production, rather than annual production.

Net Energy Metering (NEM), which is widely used in the US, aims to offset 100% of production, but is increasingly being replaced by a feed-in tariff, which drivers other behaviors, like investment in battery storage.

It is worth noting that the highest penetration in the US is in Hawaii, which was around 36% of single family dwellings in 2021 on the island of Oahu.

In addition to rising levels of penetration, the average system size has also been rising as panel efficiency has risen. Australian’s are looking to put as much capacity as possible on their roofs, aiming to maximize minimum production, rather than annual production.

Net Energy Metering (NEM), which is widely used in the US, aims to offset 100% of production, but is increasingly being replaced by a feed-in tariff, which drivers other behaviors, like investment in battery storage.

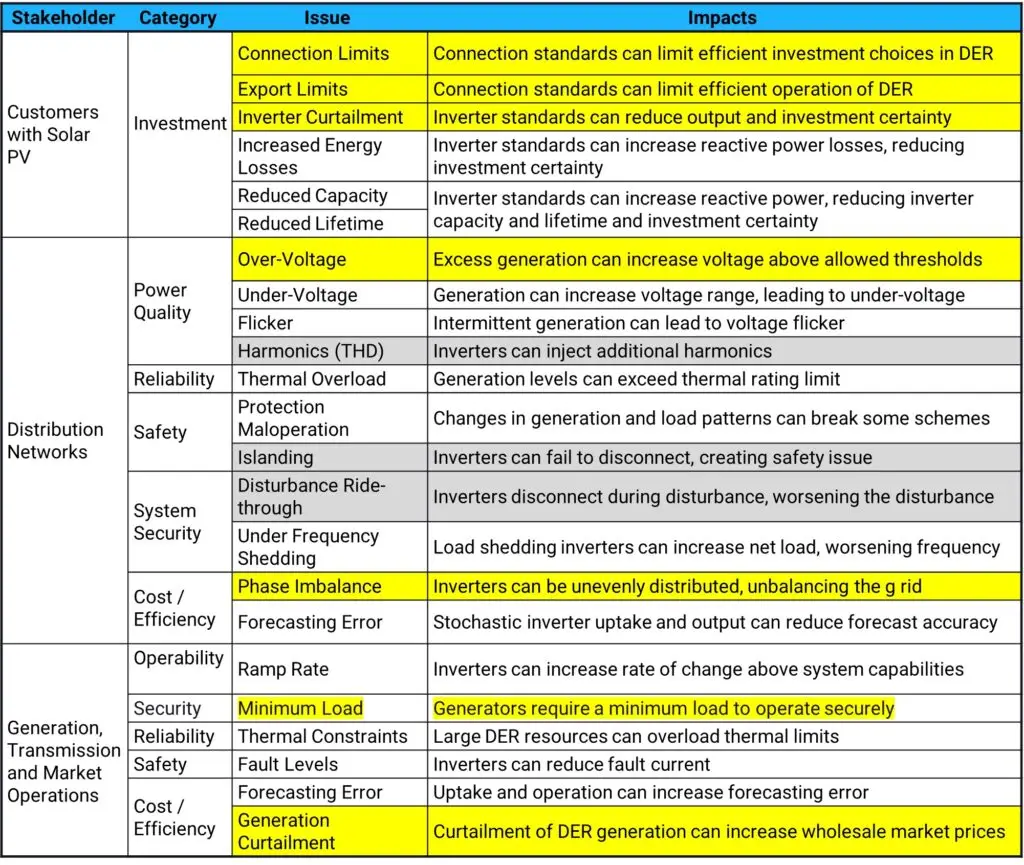

Given the market operator is forecasting 2.5 times more PV to be installed by 2050, the range of issues and their pervasiveness is expected grow in the absence of mitigation measures. The key question is how to overcome grid capacity barriers and best integrate these distributed energy resources into the grid and power system, including wholesale and ancillary services markets.

Listen or click through at your own pace

Least Cost Solar PV Hosting Solutions

Energeia was engaged by Renew as part of an Australian Energy Consumers funded project to review the options and to identify least cost PV integration solutions now and into the future. You can access our reports from that project here.

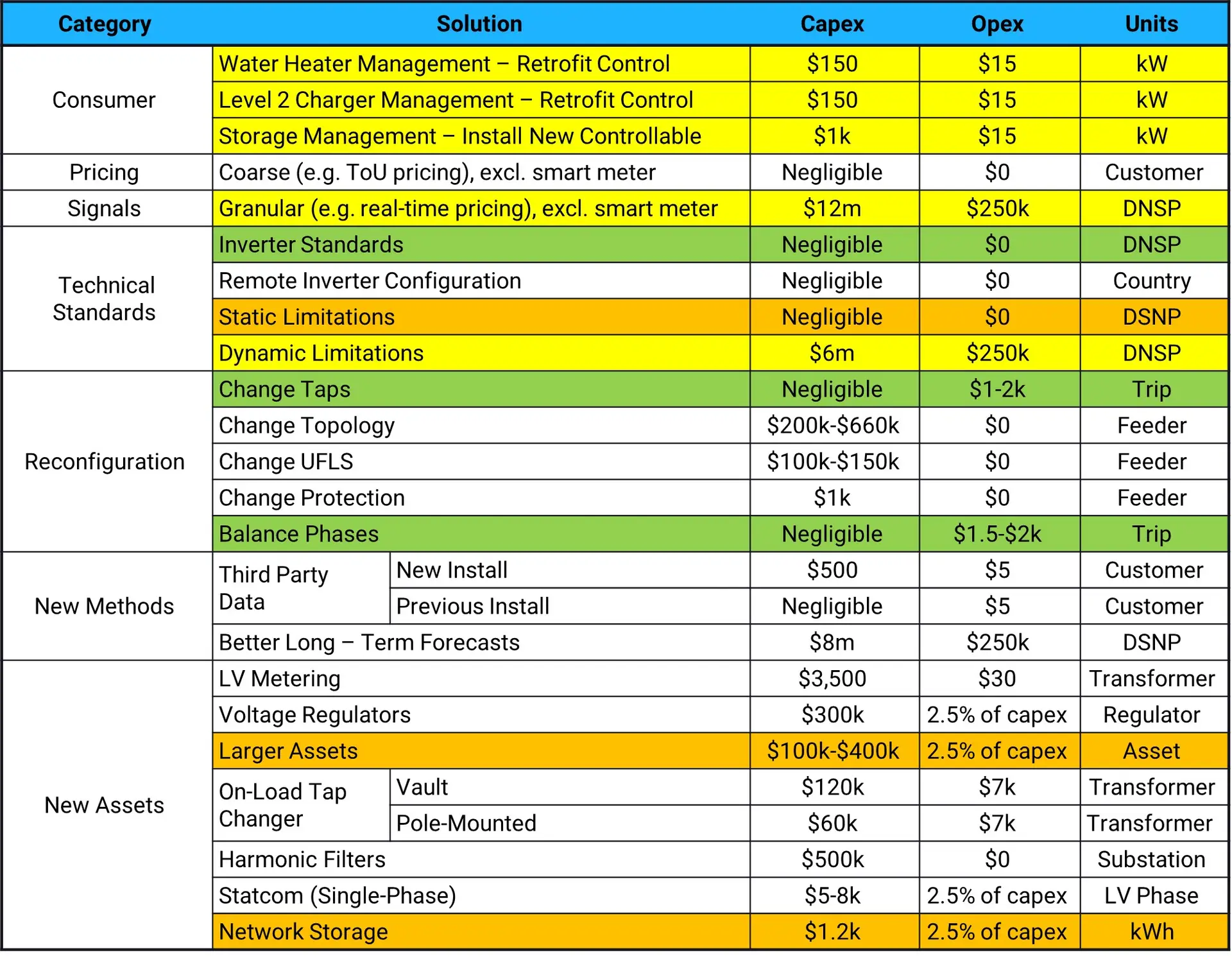

The figure below summarizes the range of PV integration options we identified by category. Solutions in green were identified as least cost, but also as finite, and likely tapped out as penetration crosses the 40-35% mark. From there, the industry has turned to the items in orange, which provide additional hosting capacity, but at a significantly higher price.

We identified that the solutions in green offered additional, low cost hosting capacity, but required development as are emerging. Of these, dynamic limitations, a.k.a. dynamic operating envelopes or DOEs, and known as flexible interconnection in the US, stood out for its ability to unlock connection and production capacity at relatively low cost.

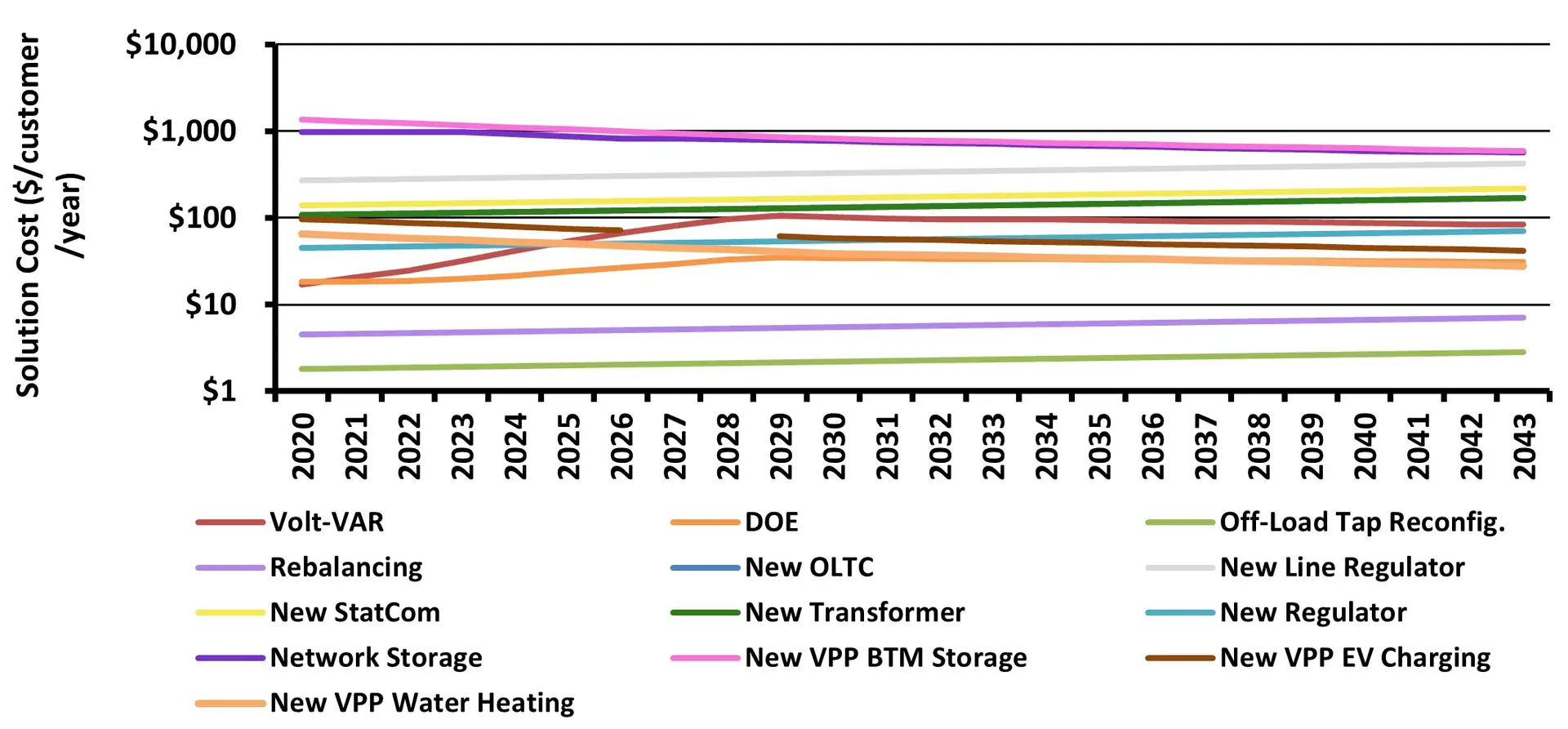

The figure below shows our estimate of the levelised cost of different options over time, which is from more recent work (Project EDGE) funded by the Australian Renewable Energy Agency (ARENA), AusNet and AEMO, which sought to determine the net benefits of implementing DOEs alongside local markets for distribution services, among other things.

Noting the log scale, the above items in green can be seen to be a fraction of the higher cost items in orange. Some items, such as smart standards (Volt-VAR), and DOEs, rise over time as the level of curtailment they drive increases. Following on from DOEs, the next least cost solution is cost reflective pricing or incentives, which are needed to unlock new Customer Energy Resources (CER), including EV charging and water heater flexibility.

The above analysis, which was based on a typical suburban LV transformer, shows that DOEs and more cost reflective network prices are needed by 2030, to avoid implementation of higher cost alternatives, including new, larger transformers, voltage regulators, etc.

Dynamic Operating Envelope Deep-Dive

DOE’s provide daily forecasts of available hosting capacity at the connection level, which is communicated to each device, which in turn operates within the envelope. This allows unlimited connection capacity in theory, though the capacity becomes increasingly curtailed.

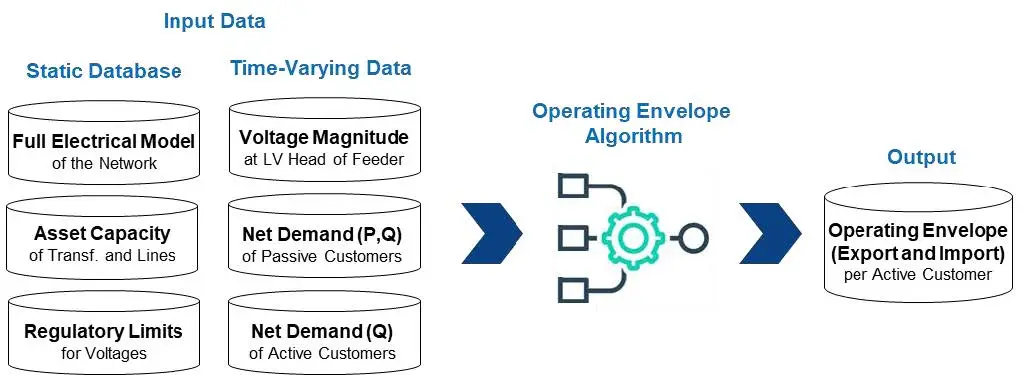

The figure below shows the key elements of a DOE system.

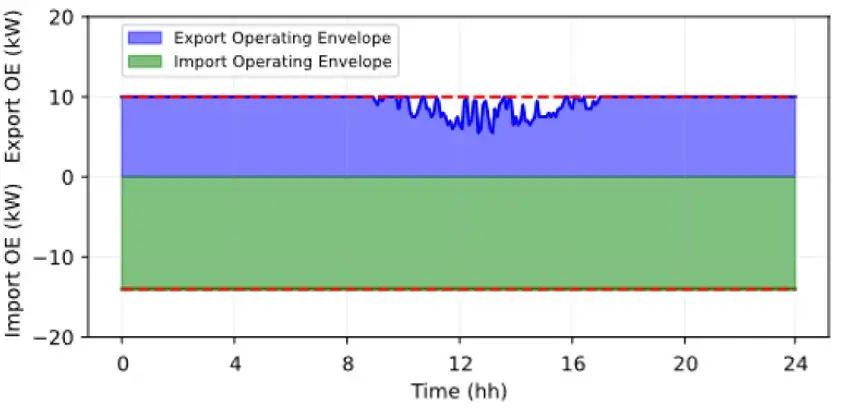

The figure below illustrates how the DOE identifies and sets constraints on a daily basis, in this case reducing the export limit during the mid-day period, where it might otherwise drive a voltage excursion 10 kW of export capacity is higher than the more typical 5 kW of connection capacity per phase set by most networks.

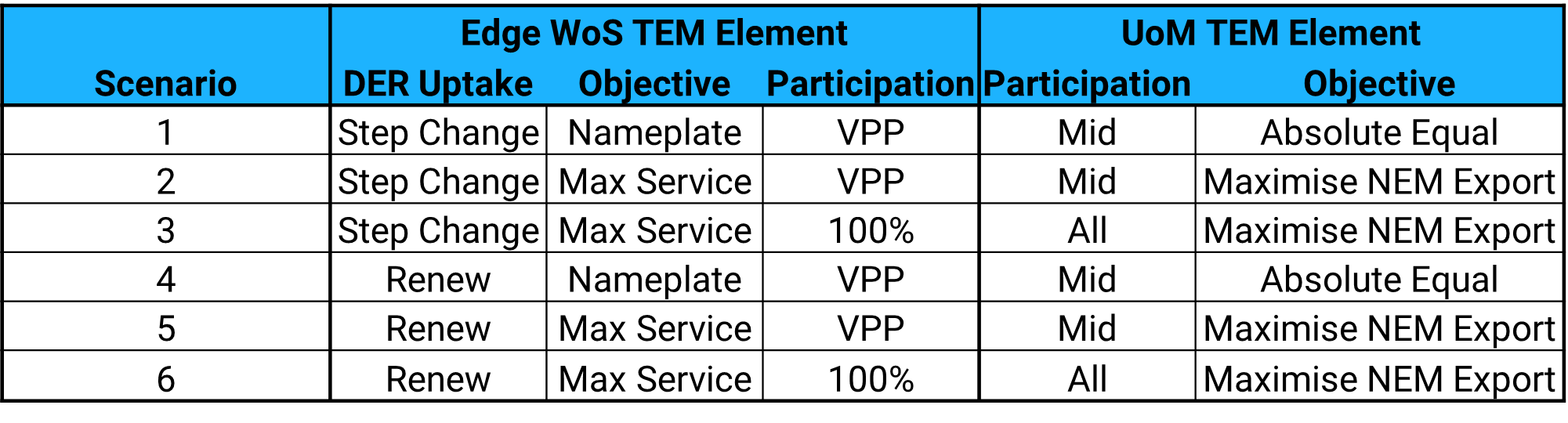

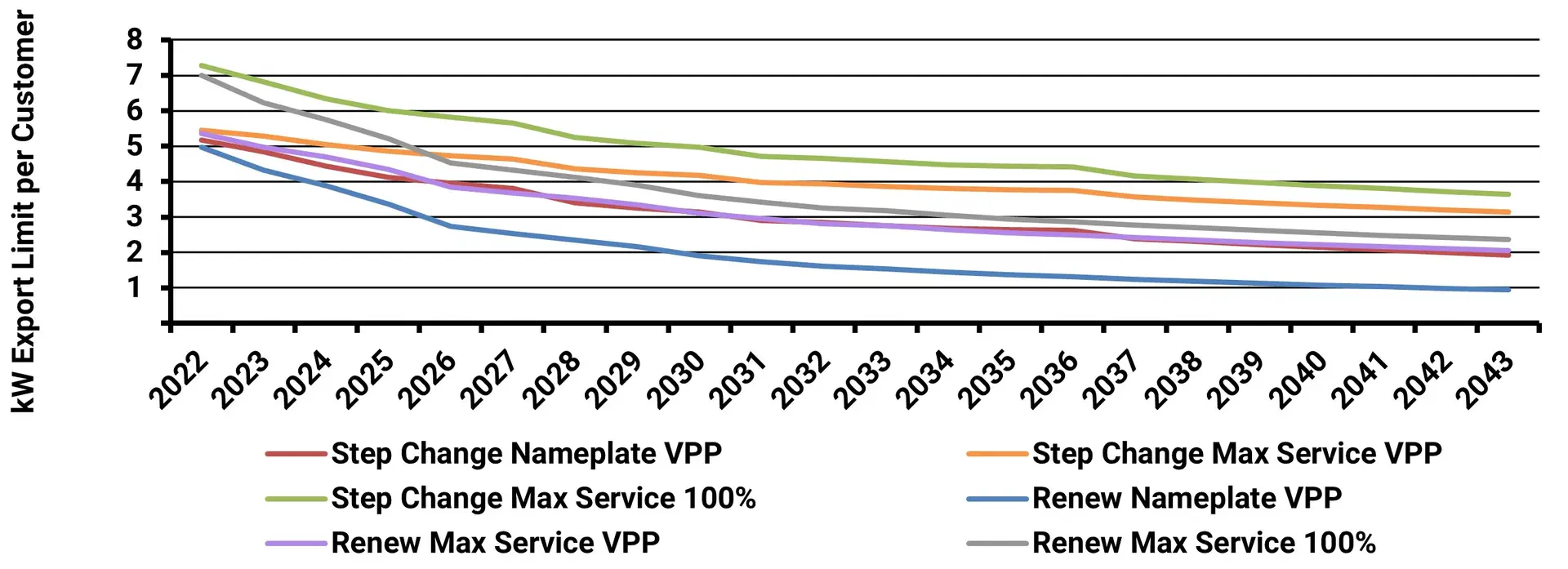

For Project Edge, we worked with the University of Melbourne to agree a range of DOE and market scenarios, which are summarized below. The UoM team estimated the DOE constraints over time based on AusNet grid data and these scenarios. DER uptake was higher for Renew, and moderate for Step Change, and the Objective was either based on everyone getting the same capacity or maximizing NEM exports. Participation was either All/100% of just those participating in VPPs.

The forecast average export limit over time by scenario is shown in the figure below. Differences are primarily driven by differences in forecast CER, with more CER leading to less hosting capacity, whether the objective function was to maximize export capacity or based on nameplate capacity, and whether some of all CER participated.

This analysis identified that DOEs unlock the most capacity where everyone is required to participate, and where the objective function is to maximise exports. Scenarios with these settings offer 50% more capacity under the high CER scenario than scenarios with them.

At the moment, whether or not to require all devices to participate is left to the networks and/or the market operator. The objective function is determined by the network, and the range of potential optimization objectives are described in more detail in the figure below.

The key thing to note from the illustrations below is that max service delivers more hosting capacity, however, it may not be seen to be fair, as CER connected electrically further away is more likely to be curtailed. Not addressing this issue via compensation could lead to a loss of social license here, and will need to be addressed at some point.

As shown in the figure above, using an equality objective function can result is much lower level of hosting capacity as penetration rises, but is probably the less controversial approach initially.

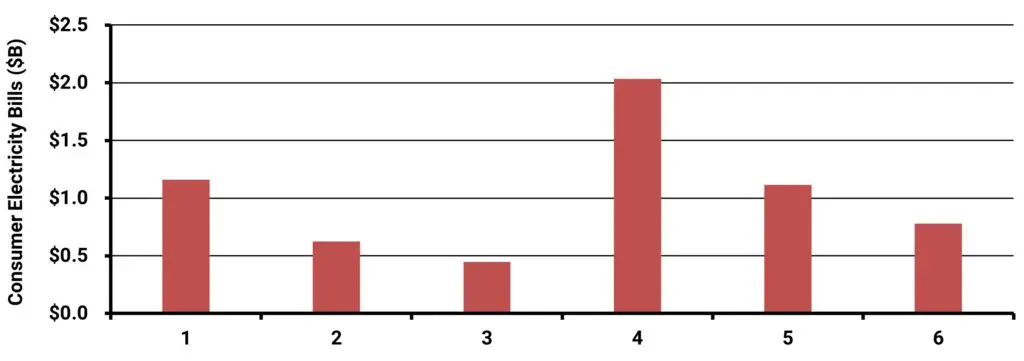

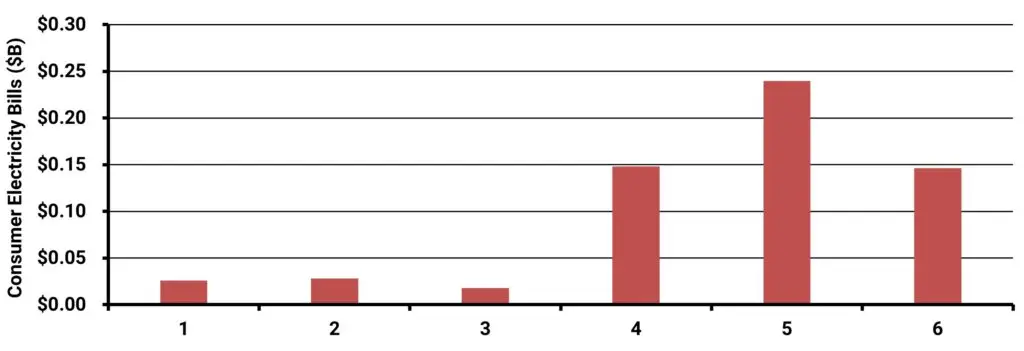

The figures below show the resulting cost of curtailment by scenario for Project EDGE. As CER reaches high levels of penetration, Scenario 6, with the max objective and 100% participation delivers the lowest level of curtailment at the distribution and wholesale market level combined.

It is worth noting that distribution curtailment costs are an order of magnitude higher than wholesale market curtailment costs.

Takeaways and Recommendations

While beneficial overall due to lower energy costs over time in every jurisdiction that Energeia has analysed, impacts from building electrification vary widely across premise types, consumer tenancy types and time. Best practice policymaking and regulation focuses on mitigating the downsides, in part via capturing a portion of the potential upside.

Key Takeaways

- Building electrification is an essential part of Australia’s decarbonization pathway

- There are four main electrification triggers: new build, replacement, end-of-life and retrofit

- Building electrification impacts different consumers differently

- Key hosting capacity barriers to electrification are higher upfront costs, higher grid costs, industry capacity constraints, and program funding

Key Recommendations

- Use bottom-up modeling of premises at the sub-load level to provide the granularity needed to identify and size the key barriers and solutions

- Overcome cost barriers via financing or rebates, recovering these costs from imposts on electricity usage aligned with expected benefits

- Address potential industry labour constraints by giving the industry plenty of notice, staggering any bands to minimize step changes in demand, and ensuring retraining capacity

- Overcome electricity grid hosting barriers including costs by ensuring cost reflective pricing avoids cost shifting and cross-subsidies, and encourages load flexibility and management

- A largely unknown key risk is the cost of gas network decommissioning, which Energeia believes could be at least in part funded by repurposing electrification benefits

For more detailed information regarding the key challenges of analysing and optimising hosting capacity, best practice methods, and insight into their implementation and implications, please see Energeia’s webinar and associated materials.

For more information or to discuss your specific needs, please request a meeting with our team.

You may also like

The Balance of Ancillary Services Pricing

FCAS exist to provide AEMO with operational reserves in case of unplanned variations in demand and supply to keep demand and supply of electricity in

Energeia Assists AEMC on Potential Rule Change

The Australian Energy Market Commission (AEMC) has proposed draft rules aimed at transforming how power companies and consumers interact.

State of the Art in Virtual Power Plants (VPPs)

Electrification of appliances and transport will radically change the optimal grid and bulk system configurations. What is a solution for managing all these resources without