- Webinars

Natural Gas Decarbonisation Strategies and Impacts

Australia is moving towards a net zero carbon future, with key sectors needing targeted actions to achieve that vision. As the combustion of natural gas creates a significant share of domestic emissions, reaching net zero necessitates decarbonising the natural gas system and its end uses.

The following sections summarise Energeia’s recent research into natural gas decarbonisation pathways, including how those pathways would impact the economy and reshape energy markets and bulk system needs. Read on to learn more about the techniques we have developed to optimise natural gas decarbonisation from a whole-of-system perspective.

Gas Sector Contributors in Australia’s Emissions

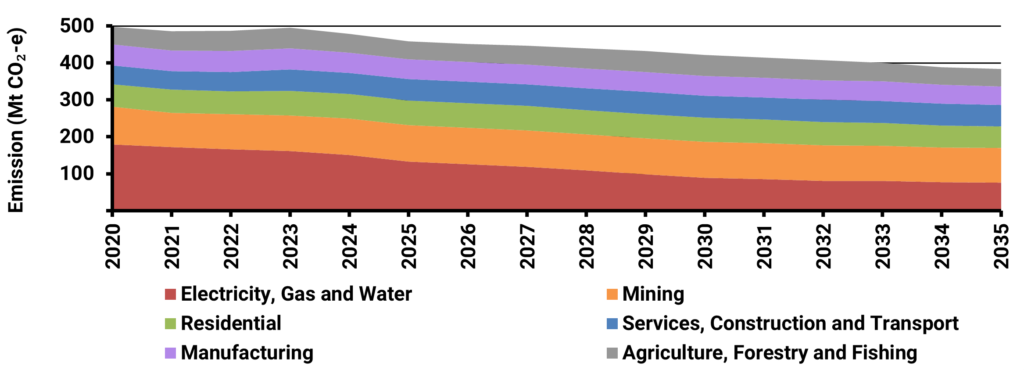

Australia is committed to the Paris Agreement and aims to achieve full decarbonisation by 2050. Figure 1 presents Australia’s emission projection by economic sector under business as usual. The most significant emission declines in electricity, gas, and water are due to existing policies like the Renewable Energy Target (RET).

Whilst electricity generation is rapidly progressing towards decarbonisation, emissions in other sectors pose challenges. In the 2022 Australian Energy Update, natural gas was stated to contribute 30-40% of mining, manufacturing, and residential building sector emissions. Therefore, decarbonising natural gas is crucial for achieving state and federal carbon reduction targets. Local and national organisations should focus on innovative strategies for natural gas decarbonisation of the system and its end uses.

Gas Decarbonisation Key Pathways

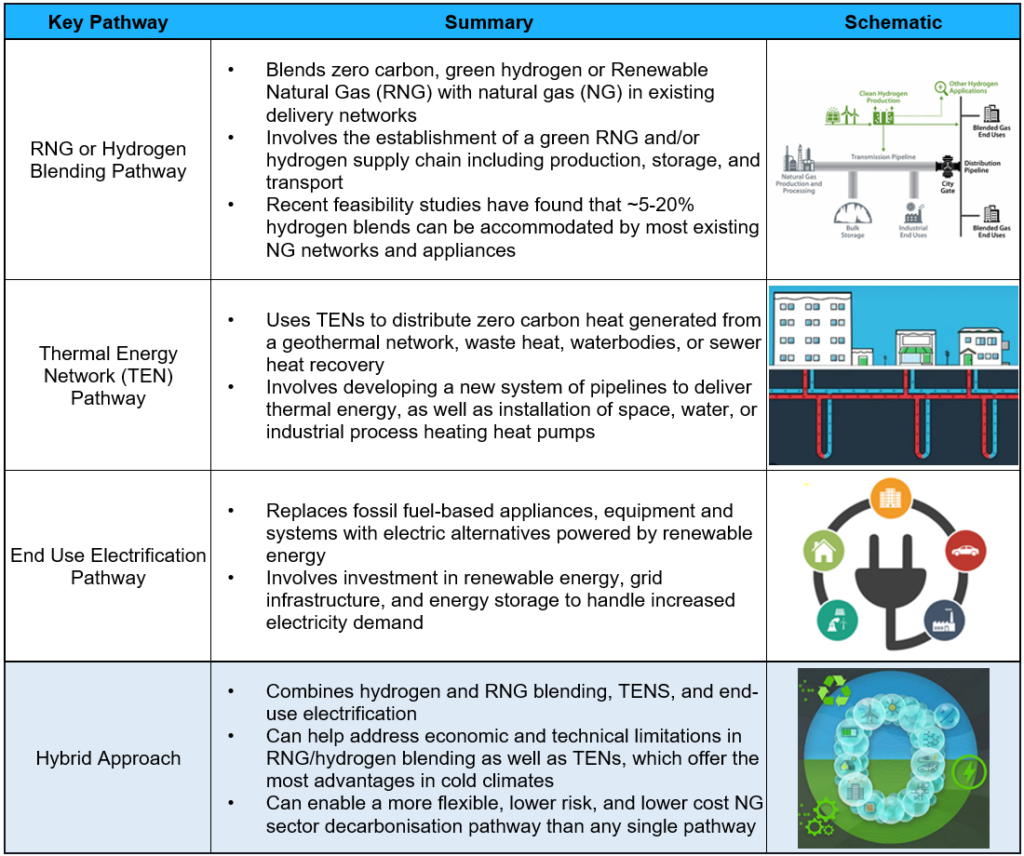

Numerous pathways to gas decarbonisation exist, with three primary approaches summarised in Table 1 below. The first approach involves altering the fuel itself. This is done by using renewable natural gas (RNG, aka biomethane) or hydrogen blending in existing delivery networks. The second approach utilises thermal energy networks (TENs) to distribute zero-carbon heat generated from sources such as geothermal networks, waste heat, water bodies, or sewer heat recovery. Lastly, end-use electrification (i.e. the replacement of fossil fuel-based appliances, equipment and systems with electric alternatives powered by renewable energy) can decarbonise most natural gas sector end uses provided there is sufficient, zero carbon electricity is available to meet demand.

Since each approach has its relative strengths and weaknesses, many jurisdictions are adopting a hybrid approach. The hybrid approach integrates one or more of these pathways, i.e. hydrogen and RNG blending, TENs, and end use electrification.

One of the key challenges facing jurisdictions is how to decommission the gas network in the face of mass electrification or a TENs, both from a technological and economic perspective.

Best Practice in Gas Network Decommissioning

International Best Practices

There are two key questions underpinning gas network decommissioning:

- How do we define a decommissioning strategy and target plan with consideration for minimal disruption?

- How do we determine who will fund the process?

Energeia researched two major projects exploring gas decommissioning – one in Northern California and the other in Austria.

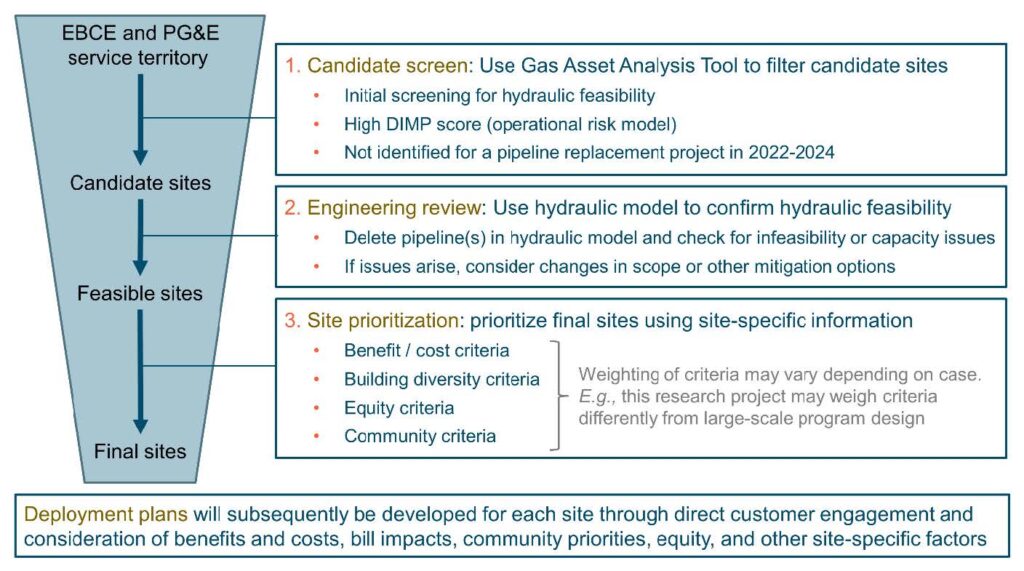

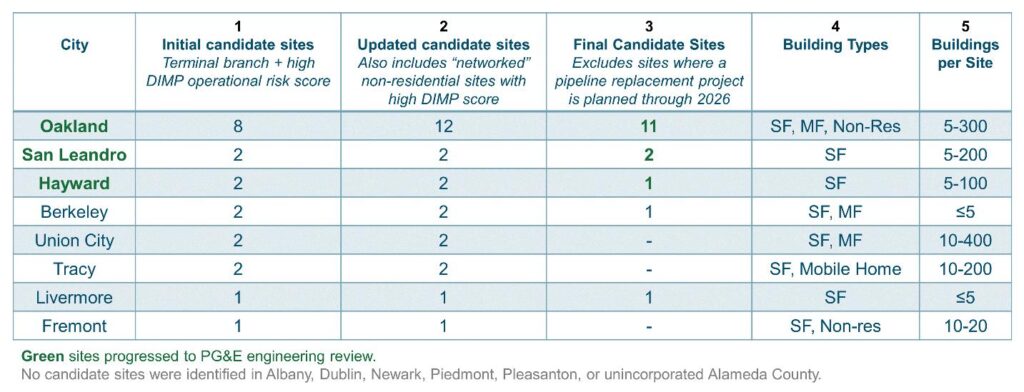

The Northern California project is a collaboration between California’s largest investor-owned utility (IOU), Pacific Gas and Electric (PG&E), and the California Energy Commission (CEC). [1] The study focused on the Oakland area and explored the effects large-scale gas network decommissioning would have on consumers, especially in economically burdened communities.

The University of Vienna project investigated the most cost-effective decommissioning and refurbishment approaches for existing gas networks. The project included a case study analysis of a portion of the existing Austrian gas network.[2]

Both analyses prioritise the order of staged decommissioning segments of the gas infrastructure under two key considerations:

- Hydraulic Feasibility

- Cost Effectiveness

Figure 3 diagrams the sequencing criteria for decommissioning regional gas networks and the prioritisation system is then tested via a series of pilots, such as those listed in Table 4.

Informed by these studies and other research, Energeia developed a gas decommissioning optimisation framework to identify the best segmentation approach:

- Categorise consumers into defined areas, with priority based on cost per unit of consumption

- Categorise distribution system segments and identify those with low cost decommissioning, e.g. spurs, or high near-term investment needs, failing asset classes

- Prioritise decommissioning of the gas segments with the highest cost-to-serve per unit of consumption and lowest net decommissioning costs

To accurately understand the impact of removing segments of the gas network, hydraulic load flow modelling is used to quantify the impact and to identify related least cost investments needed to stabilize pressure where needed.

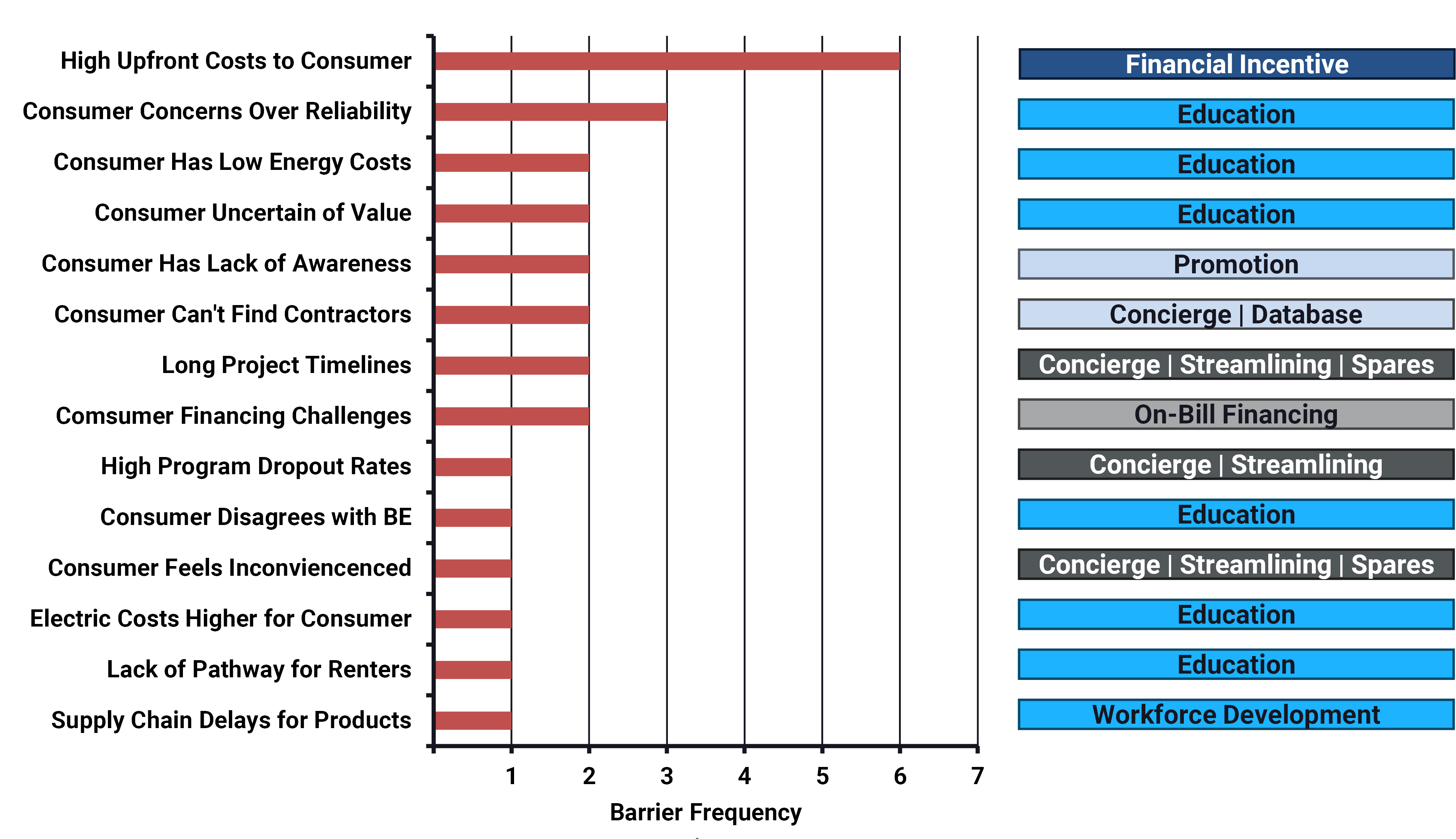

In addition to determining the least cost approach for the distribution network, Energeia researched customer barriers to gas decommissioning. Our key finding, shown in Figure 4, was that customers primarily concerned with the high upfront costs of electrification.

Listen or click through at your own pace

Based on the above, Energeia identified key strategies for policymakers to address these key consumer barriers:

- Economic support for consumers to overcome the higher upfront costs of electrification

- Streamlining the electrification process with turnkey services can assist in addressing the inconvenience barrier from switching over existing gas end uses, and

- Educating consumers about the financial and non-financial benefits of electrification

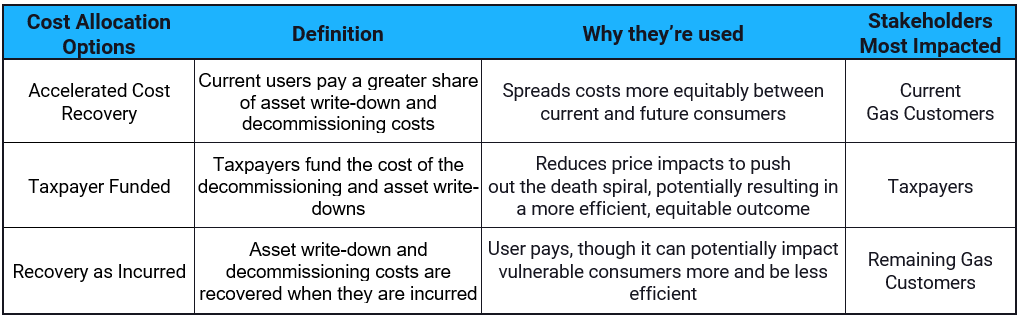

There is also the issue of who should bear the cost of decommissioning and writing down the gas network assets. The AER[3] has allowed gas network owners to use accelerated asset depreciation to recoup costs sooner while more consumers continue using the gas network. However, the possibility of a death spiral for the consumers connected to gas persists while mass electrification occurs. Government agencies and regulators have not yet resolved this point of contention.

A 2024 report by Ofgem in the UK identifies the key issues and potential options for who funds the remaining gas assets. Options for who pays include:

- Government – Write-down and decommissioning costs are recouped from current and future consumers,

- Gas network investors – Ofgem highlights this would “create asset stranding risk” and [4],

- Future consumers – Ofgem notes that this will be a relatively small group of consumers, with many falling into ‘vulnerable’ categories,

- Current consumers – Requires an increase in network charges from 2026,

- Purchasers of the networks for repurposing – The network owners would probably claim any residual asset value to be theirs regardless of the Regulatory Asset Value (RAV) position.

Similar discussions are being had in most other jurisdictions, but few appreciate the impact on decommissioning cost efficiency.

Optimising Gas Decarbonisation

Energeia developed an economic model of Australian gas network decommissioning under two shutdown scenarios based on the best practice research above. This model was used to evaluate the effect these different scenarios would have on the speed at which gas network assets are decommissioned and customers electrify.

The two gas network shutdown methods modelled were:

- Threshold – This scenario involves shutting down the gas network by suburb once a certain threshold is reached, based on a percentage reduction in gas consumption compared to the base year. For this analysis, the threshold percent reduction was assumed to be 20%, being the threshold below which it is cheaper to decommission.[5]

- Phased – This scenario shuts down an equal number of suburbs each year over a predefined period, resulting in the steady decommissioning of the entire gas network. This approach may be more realistic from a planning and delivery point of view, but at the cost of potentially higher costs due to premature decommissioning.

In addition to the planning optimisation, another important factor for utilities to consider is the decommissioning cost allocation.

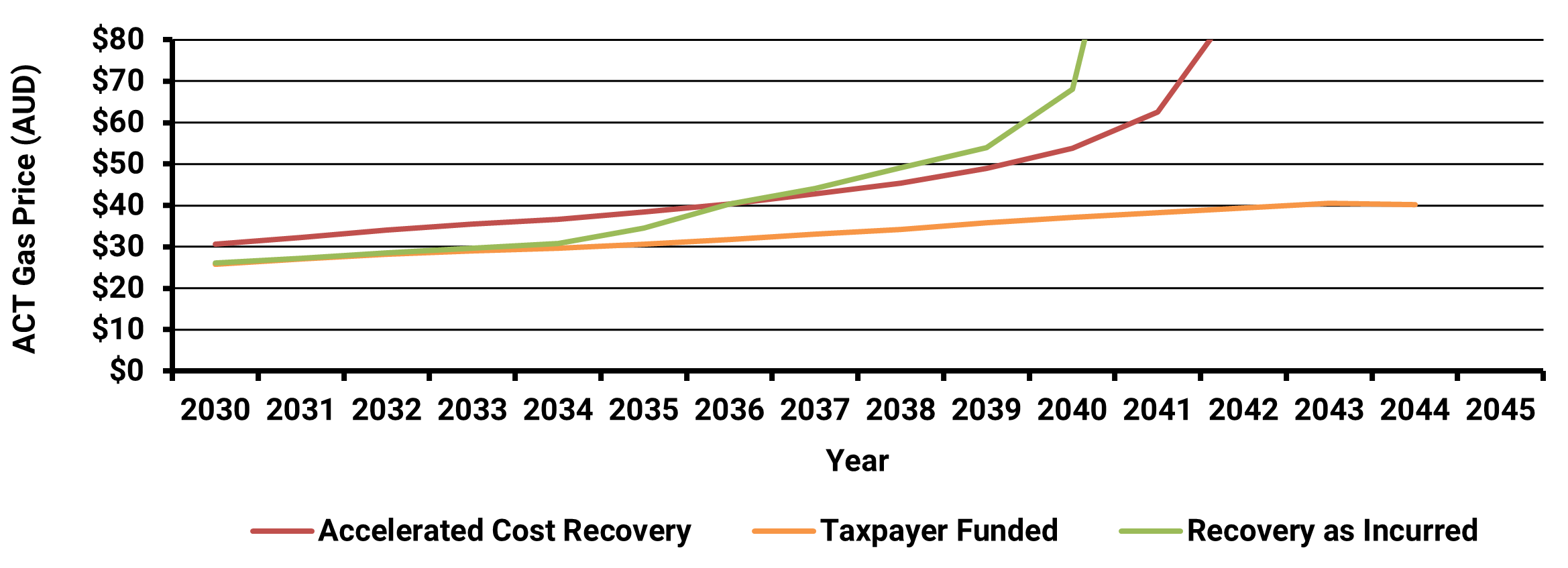

Energeia developed a set of gas network cost allocation policy scenarios to be tested under the two gas network shutdown scenarios described above using our customer price response model. The cost allocation scenarios aim to test how the rate of consumer electrification is impacted by different methods of recovering gas network asset value and decommissioning cost. The three cost allocation policies Energeia modelled can be seen in Table 6 below:

Figure 5 illustrates the impact of these cost allocation options on gas network prices for the phase scenario. The results show that the taxpayer-funded method helped to keep gas prices down, preventing mass consumer defection as costs rise. This approach can minimise the write-down costs for consumer gas appliances and industrial gas assets.

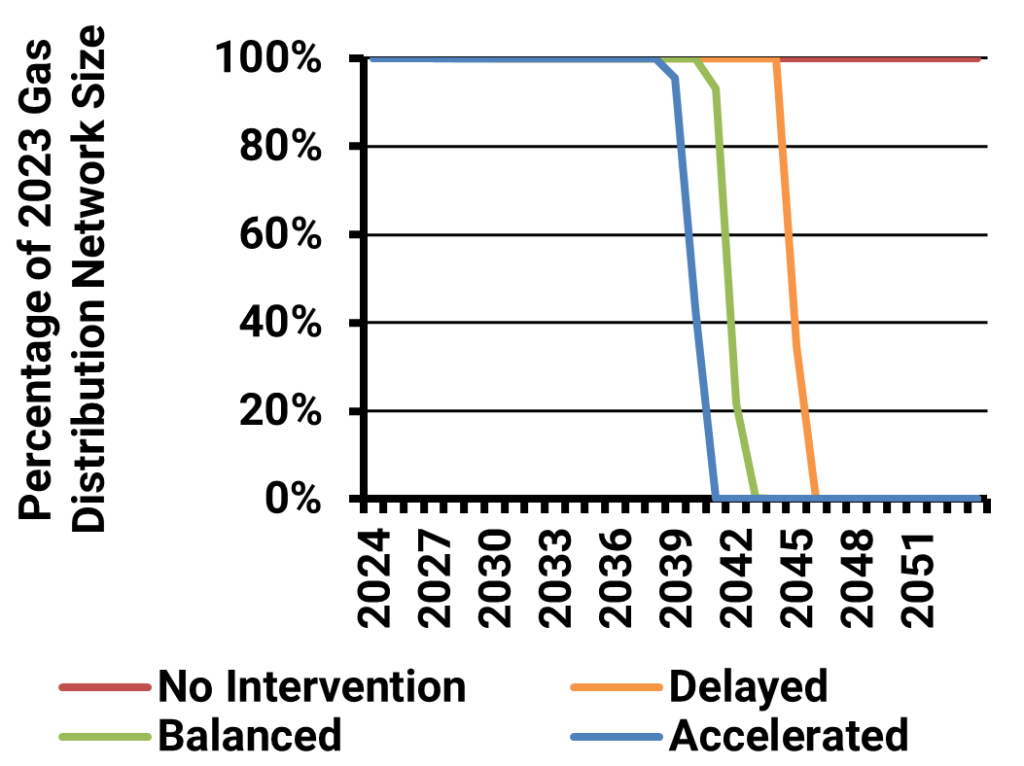

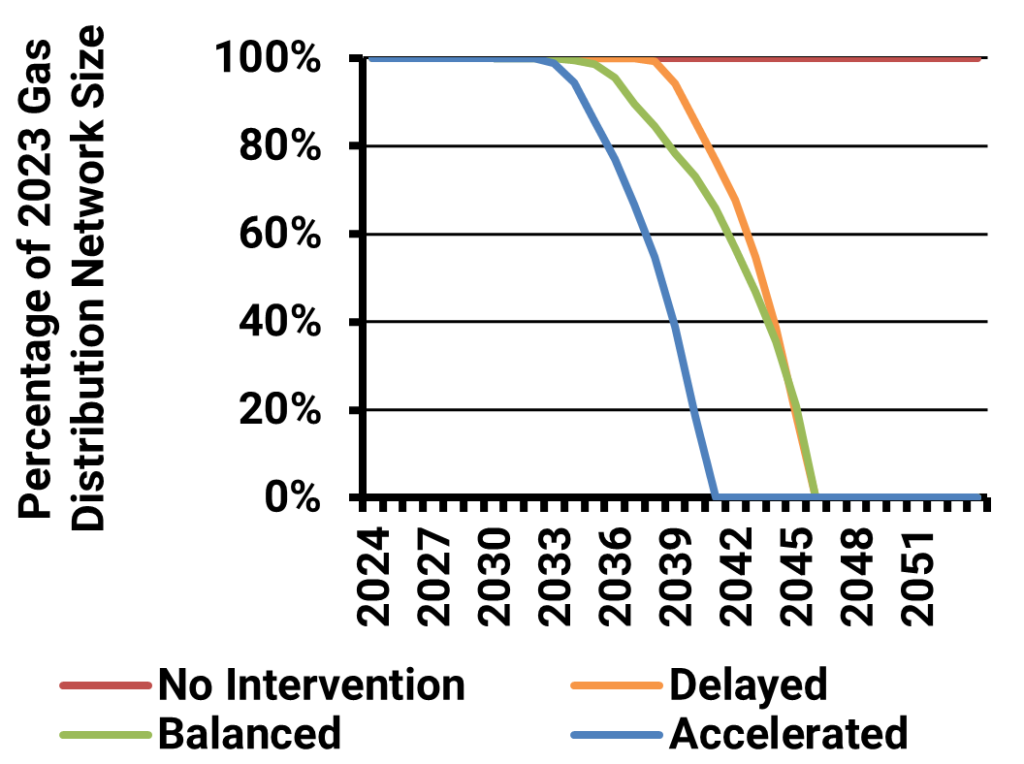

Energeia also modelled the impact of different policy support levels for the Phased decommissioning and Accelerated Cost Recovery scenario. Four different rates of policy support from highest to lowest were modelled: no intervention, delayed, balanced, and accelerated. The impacts of these policy scenarios on phase network decommissioning (as a % of 2023 network size) are shown in Figure 6. The analysis shows that the threshold approach can lead to rapid shutdowns, due to consumer defection from higher gas network prices under an accelerated cost recovery policy.

Takeaways and Recommendations

The key takeaways and recommendations for gas decommissioning (derived from Energeia’s best practice research and innovative analysis) are summarised below.

Key Takeaways:

- As the fourth largest source of CO2 emissions by fuel type, decarbonising Australia’s natural gas consumption is essential

- Electrification is one option for decarbonisation; however, there are other options including green hydrogen, other clean fuels, and TENs

- A hybrid approach appears to be the most common current approach, which enables technological advancement

- Electrification can deliver full decarbonisation of the natural gas system, but it comes at a cost, which includes gas asset write-downs and decommissioning costs

- Optimising decommissioning costs requires a whole-of-system approach (including electricity and gas sectors, and consumer equipment costs)

- Gas decommissioning data availability is limited; more robust and accessible data is needed to identify the optimal pathway

- Key considerations include decommissioning timing, duration, triggers and segmentation of the gas system, as well as bans, incentives, and cost allocation

- Significant decommissioning and write-down costs, including customer appliances, may favour pushing out these costs

Key Recommendations:

- Take a wide view of potential pathways to decarbonising the natural gas system, including TENs and clean fuels to minimize overall costs

- Investigate costs for emerging technologies like TENs and zero-carbon fuels and potentially invest in research and development to bring costs down

- More data on costs is essential to making the best possible decisions

- When optimising the decarbonisation pathway, it is essential to take a whole-of-system approach, including customer appliance costs

- Cost allocation is a key policy decision to be made, due to the feedback loops involved and recovery of costs from fewer users and usage

[1] Tactical Gas Decommissioning Project Overview (2022), see https://gridworks.org/2022/06/tactical-gas-decommissioning-project-overview/

[2] Designing a model for the cost-optimal decommissioning and refurbishment investment decision for gas networks: Application on a real test bed in Austria until 2050, see https://www.sciencedirect.com/science/article/pii/S2211467X23000883

[3] Australian Gas Networks Gas distribution access arrangement (2023), see https://www.aer.gov.au/system/files/AER%20-%20AGN%202023-28%20-%20Final%20decision%20-%20Attachment%204%20Regulatory%20depreciation%20-%20June%202023_0.pdf

[4] RIIO-3 Sector Specific Methodology Consultation – Finance Annex (2024), Ofgem https://www.ofgem.gov.uk/sites/default/files/2023-12/RIIO-3%20SSMC%20Finance%20Annex.pdf, pg 69.

[5] The actual threshold requires significant analysis and will be utility specific.

For more detailed information regarding the key challenges of analysing and optimising VPPS, best practice methods, and insight into their implementation and implications, please see Energeia’s webinar and associated materials.

For more information or to discuss your specific needs, please request a meeting with our team.

You may also like

Economic Benefits of NSW Gov Public EV Fast Charging Strategy

The NSW Government analyzed the cost-benefit of public fast-charging infrastructure for electric vehicles (EVs), comparing funded and unfunded scenarios over 20 years. Results indicated that

The Future of Data Centre Electrical Grid Impacts

The rapid expansion of data centres to support AI, cloud computing, and digitization is reshaping electricity demand and challenging grid planning. Energeia’s research highlights the

Natural Gas Decarbonisation Strategies and Impacts

Energeia’s research outlines key pathways, including renewable gas blending, thermal energy networks, and end-use electrification, all vital for achieving carbon targets while minimizing economic disruption.