- Webinars

COVID Holds the Key to the Future of Transportation Electrification

The impact of the COVID pandemic on the driving habits of Australians could significantly dampen the uptake of electric vehicles across the country, despite increases in petrol prices and the availability of new EV models, government rebates and public charging infrastructure.

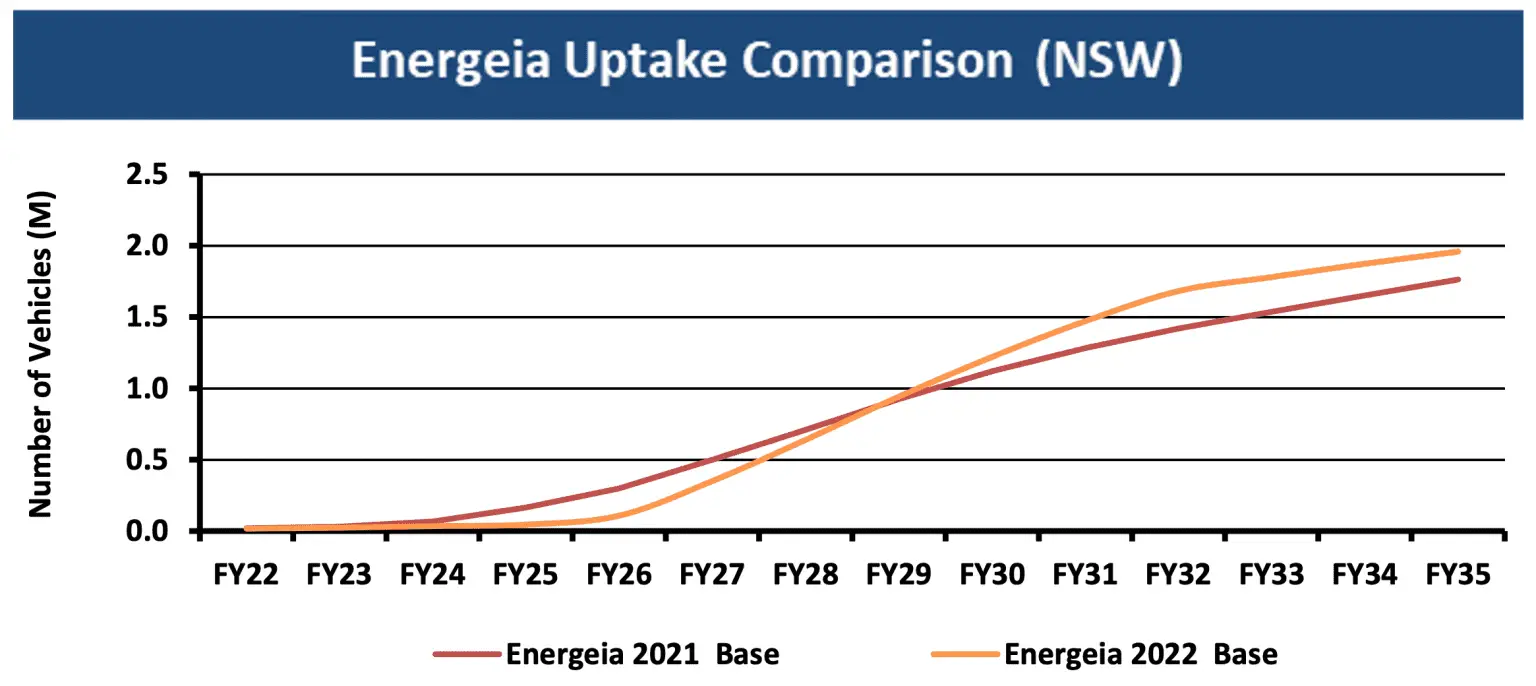

The findings come from Energeia’s recent modelling that shows COVID driven reductions in demand for transport and increases in vehicle prices are behind the change, and it will take at least three years to correct, depending on COVID’s impact on forecast GDP and population growth.

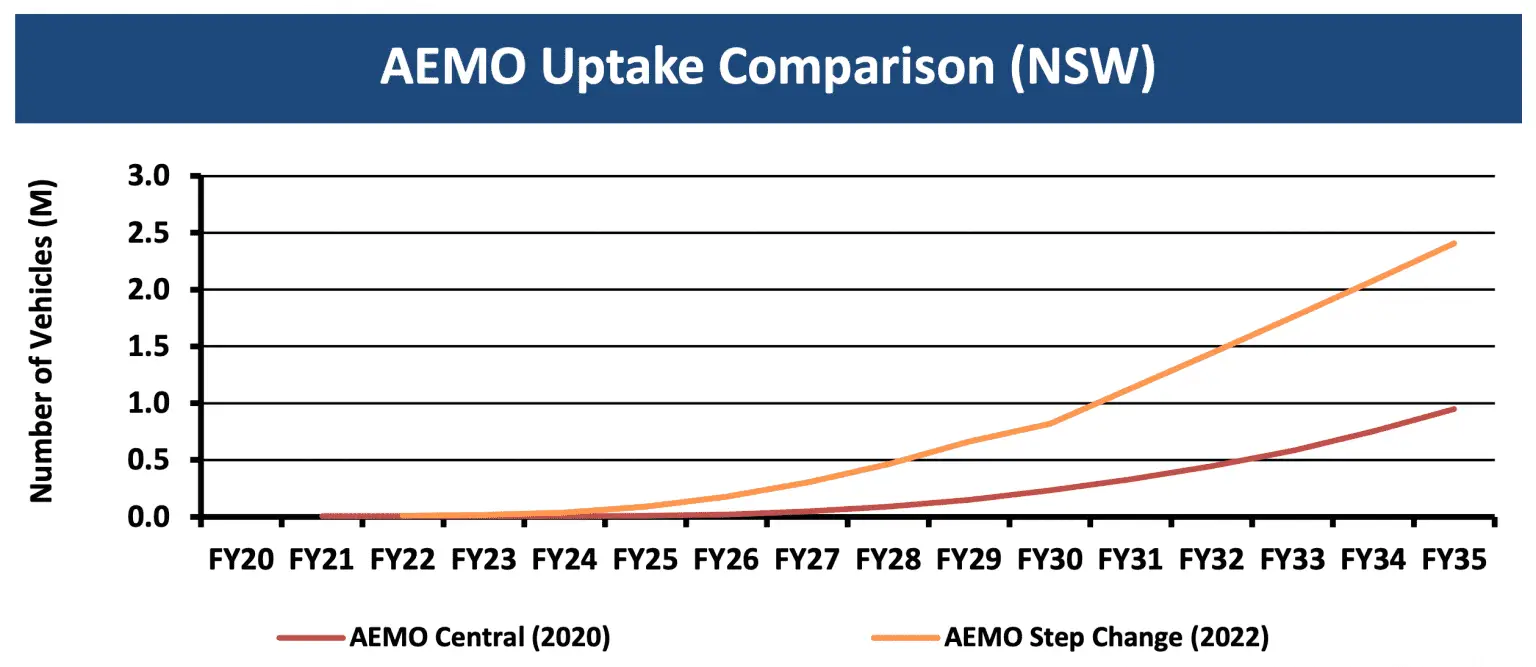

The new results stand in contrast to the predicted EV adoption levels from the Australian Energy Market Operator’s (AEMO) Step Change scenario in its latest Integrated System Plan(ISP), which outlines an altogether more bullish outcome.

Market Operator Sees Step Change in EV Sales

When AEMO released its updated ISP late last year supporting a change from its Central Scenario to its Step Change Scenario it also led to predictions of skyrocketing EV sales across the country.

The difference between the two scenarios was large – almost 1.5 million extra EV sales in NSW alone by 2035.

The vast majority of stakeholders consulted on the change in ISP scenarios overwhelmingly agreed that Australia was most likely heading in the Step Change scenario direction.

In normal circumstances, recent changes to key uptake drivers would support rates of EV adoption in AEMO’s Step Change Scenario. However, COVID is redefining what is normal.

Energeia has been advising governments and the energy and motoring sectors on electric vehicle sales drivers and outlooks for the past decade.

Our research has found most of the key drivers of EV sales have been increasing:

- Increases to state government rebates and incentives, and recent steep increases to petrol prices are helping to reduce economic barriers.

- Greater availability of public charging infrastructure and faster charging are reducing range anxiety and other refuelling related barriers

- More electric vehicle makes and models are appealing to a wider range of potential buyers, offset somewhat by reductions in stock due to supply chain issues

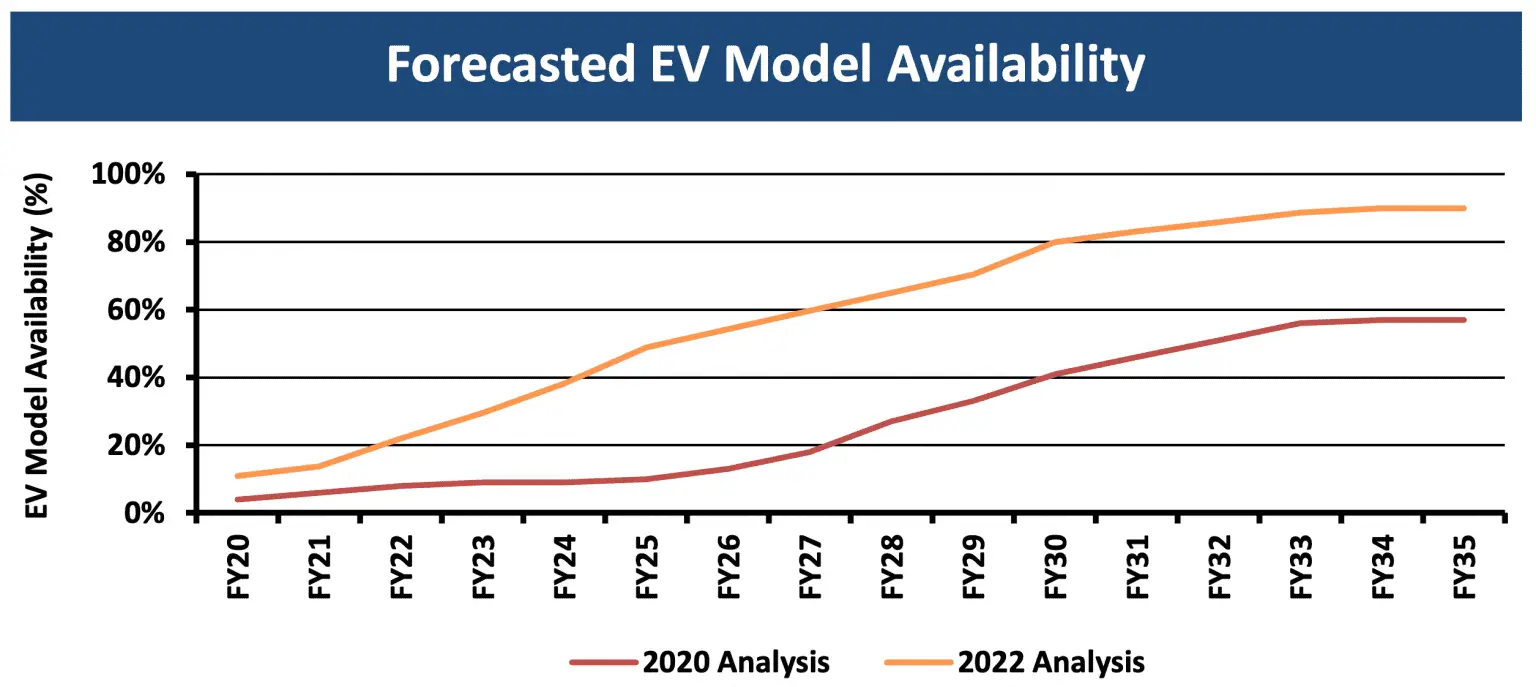

We now expect that just over 80 percent of passenger vehicles models in Australia will have an EV version by 2030, many years earlier than our 2021 view.

Changes in our outlook for key EV adoption drivers are all pointing to Step Change type increases in EV sales – under normal circumstances.

However, Energeia’s 3rd generation transport demand model has identified an underlying weakness in this outlook.

The impact of COVID on demand and supply of transportation

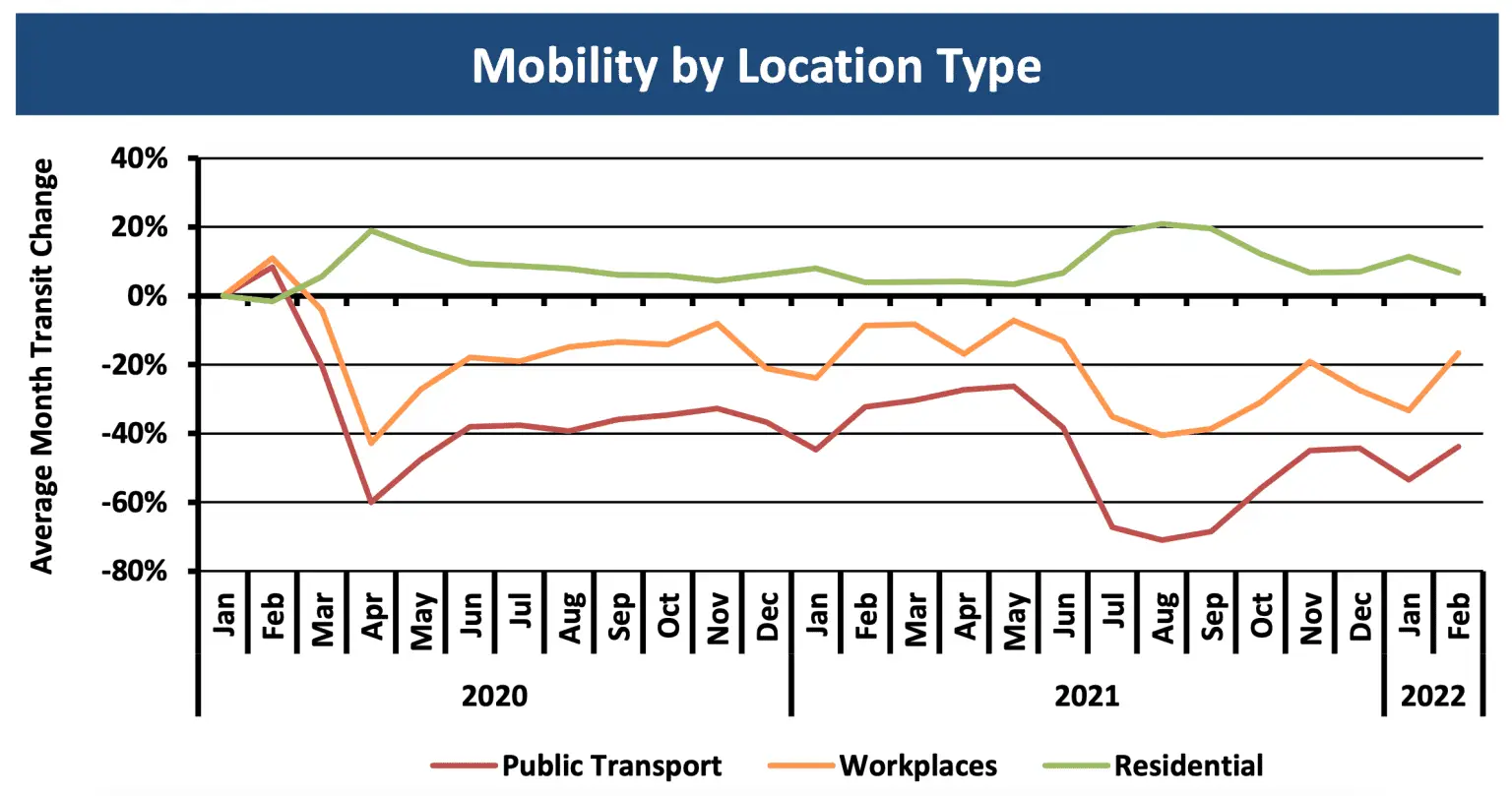

Like many other sectors, our latest modelling shows COVID is significantly impacting demand for transport. It’s not normal circumstances.

Demand for transportation, which drives demand for new vehicles, is down for private commuting between 20-40% compared to pre-COVID levels in Australia.

The impact is significant enough, according to our transport model, to offset the growth from all other drivers impacting EV sales over the next decade.

The result – our new updated Base Case for EV adoption in Australia – remains stuck at 2020/2021 levels, well below AEMO’s Step Change forecasts.

As a result, the difference between our Base Case and AEMO’s equivalent Step Change scenario (shown at the beginning) is equal to about 0.4 million fewer electric vehicles across NSW by 2035.

You may also like

Bridging the Skills Gap: Workforces for Electrification

Australia’s clean energy transition demands a skilled workforce. Energeia’s analysis reveals urgent needs, strategic solutions, and policy pathways to bridge the electrification skills gap and

Unlocking the Potential of Consumer Energy Resources

The AEMC partnered with Energeia to explore how flexible Consumer Energy Resources (CER), like solar, batteries, electric vehicles, and smart appliances, can reduce costs and

Optimizing DC Fast Charging Tariff Structures

Energy Queensland collaborated with Energeia to address financial barriers in EV charging infrastructure, focusing on high network tariffs and demand charges. The study evaluated alternative