- Webinars

State of the Art in Virtual Power Plants (VPPs)

Electrification of appliances and transport will radically change the optimal grid and bulk system configurations. The Australian Energy Market Operator (AEMO) is forecasting a 2.5 times increase in rooftop solar PV (PV), a 240 times increase in electric vehicle (EV) consumption, and a 30 times increase in small-scale battery capacity by 2050. The key to managing all these resources without a significant increase in the cost of the grid is virtual power plants (VPPs).

The following sections summarise our recent research into consumer decisions in Australia, how those decisions have rapidly reshaped grid and bulk system needs, and the power system’s optimal structure and economic regulation structure. The evolving landscape of consumer energy resources (CER) and the increasing need to integrate solar, storage solutions, and electric vehicle charging into VPP frameworks are just a few rapidly evolving areas.

Consumer Decision Impacts

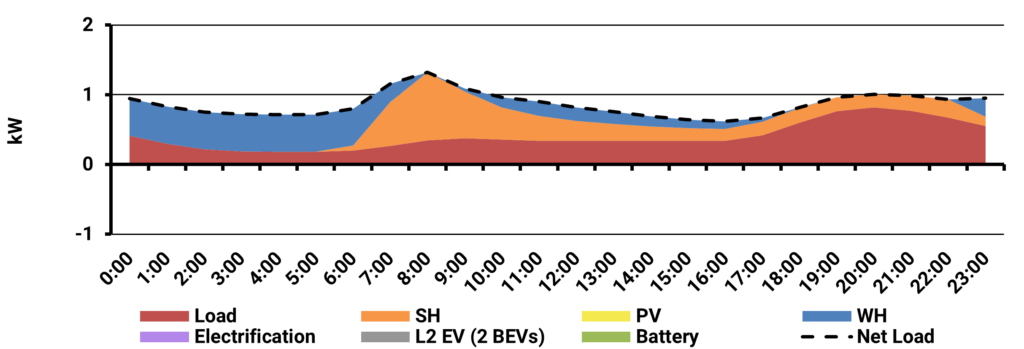

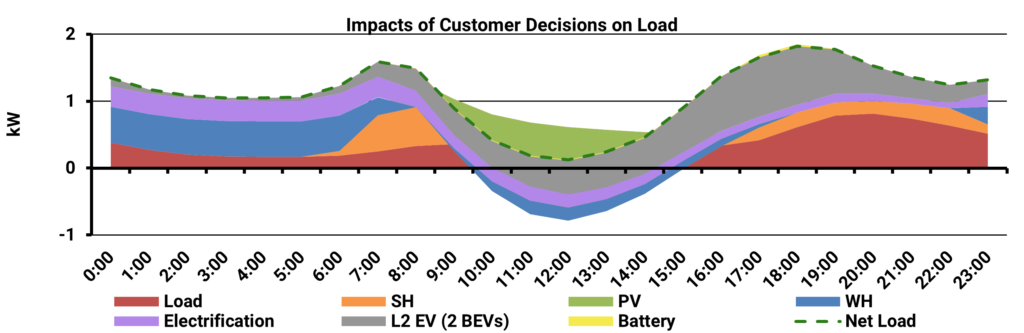

Energeia has estimated that consumer decisions regarding the electrification of transport, along with space and water heating appliances, could increase the average premise consumption in Victoria by over 50% and alter the timing of electricity use. Figure 1 and Figure 2 below shows the before and after changes in load profile on an average winter day for residential customers in Victoria.

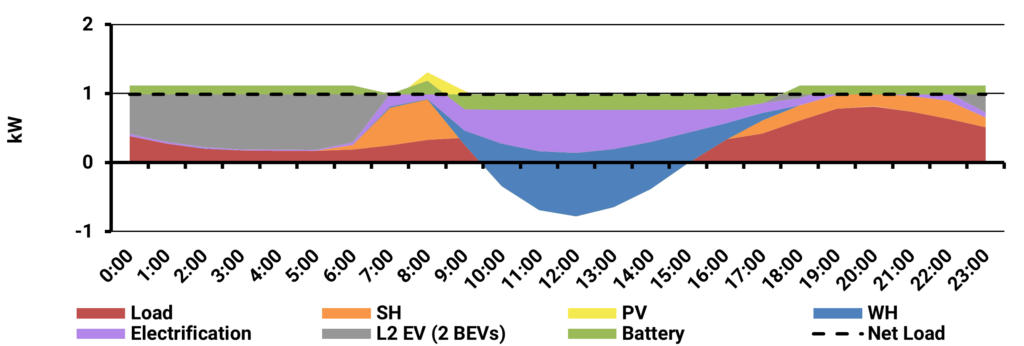

Being able to shift flexible consumption from EVs and appliances, as well as, orchestrating behind the meter (BTM) resources like solar PV and battery storage, via a VPP, can result in a very low cost to serve outcome for distribution utilities by flattening energy usage profiles throughout the day as represented below in Figure 3.

VPP System Economics

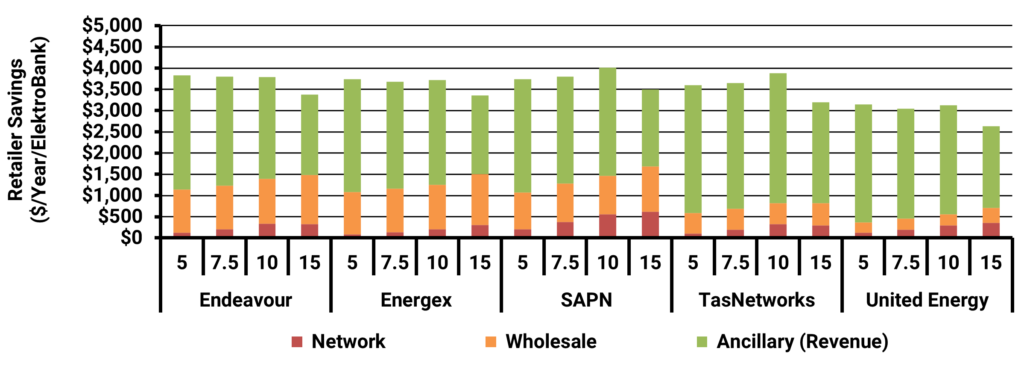

To illustrate the economics of VPP systems, we analyzed the potential benefits they could deliver and their impact on customer bills. Modelled below (Figure 4) is the potential value of a VPP to a retailer using a Tesla Powerwall 2 in a VPP. It showed that there is a large potential for retailers to save on costs and especially to earn revenue on the FCAS market.

The potential for customers to see an increase in their bill due to VPP operation is not represented here but can be found in the presentation [LINK]. Energeia notes that, tariff and VPP benefits will converge as retail tariffs become more cost reflective.

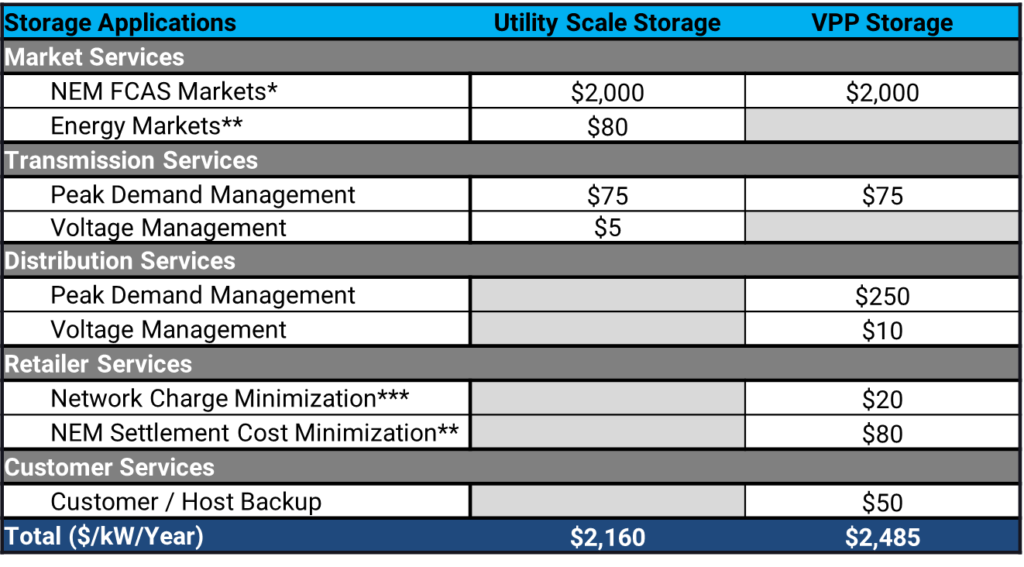

Another key finding of our research and analysis is that residential battery storage based VPPs, while being 50% cheaper on an installed basis can also deliver 15% more value to retailers than utility scale storage assets as outlined in Table 1 below.

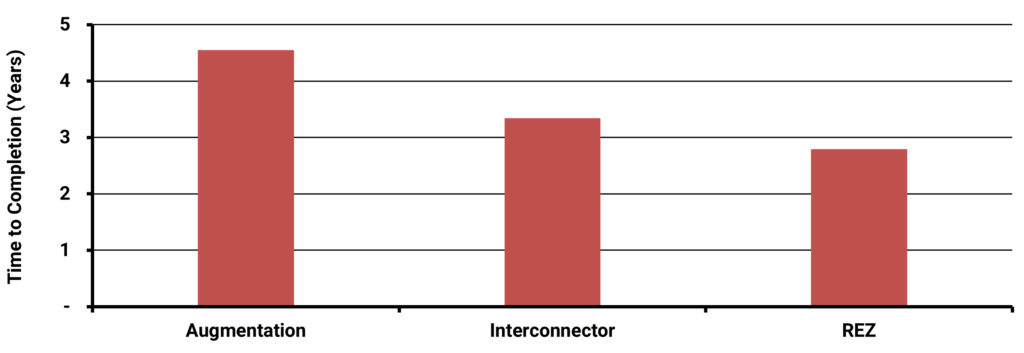

VPPs are also not subject to the lengthy connection lead times of that utility scale storage is currently subject to. Figure 5 below clearly shows that connecting to Renewable Energy Zones infrastructure is significantly faster than standard augmentation.

Listen or click through at your own pace

Outlook for VPP Feedstock

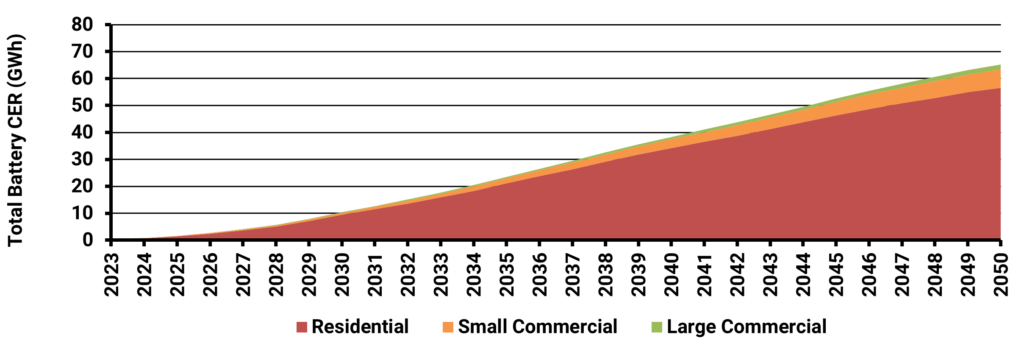

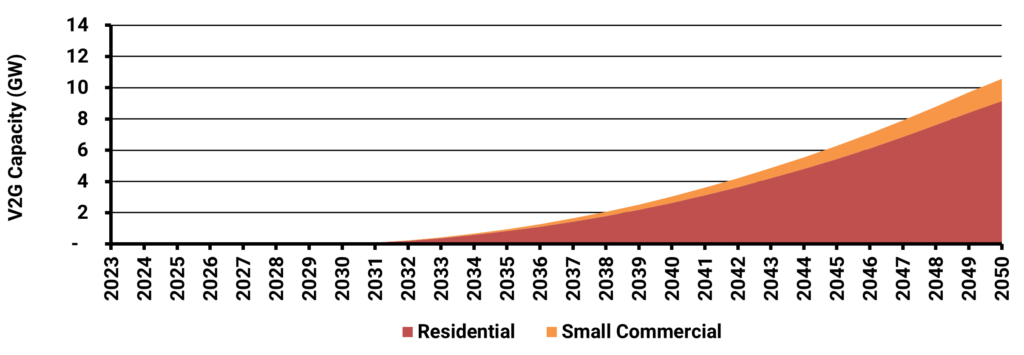

Our analysis as found that the two top feedstocks for Australian VPPs into the future are batteries and electric vehicles via vehicle-to-grid (V2G) discharging. We have forecasted the growth for residential, small and large commercial total battery CER and V2G capacity through 2049 below in Figure 6 and Figure 7, based on market operator data.

With such a large volume of flexible storage coming onto the opportunity for VPP operators will continue to grow.

The Competitive Landscape for VPPs

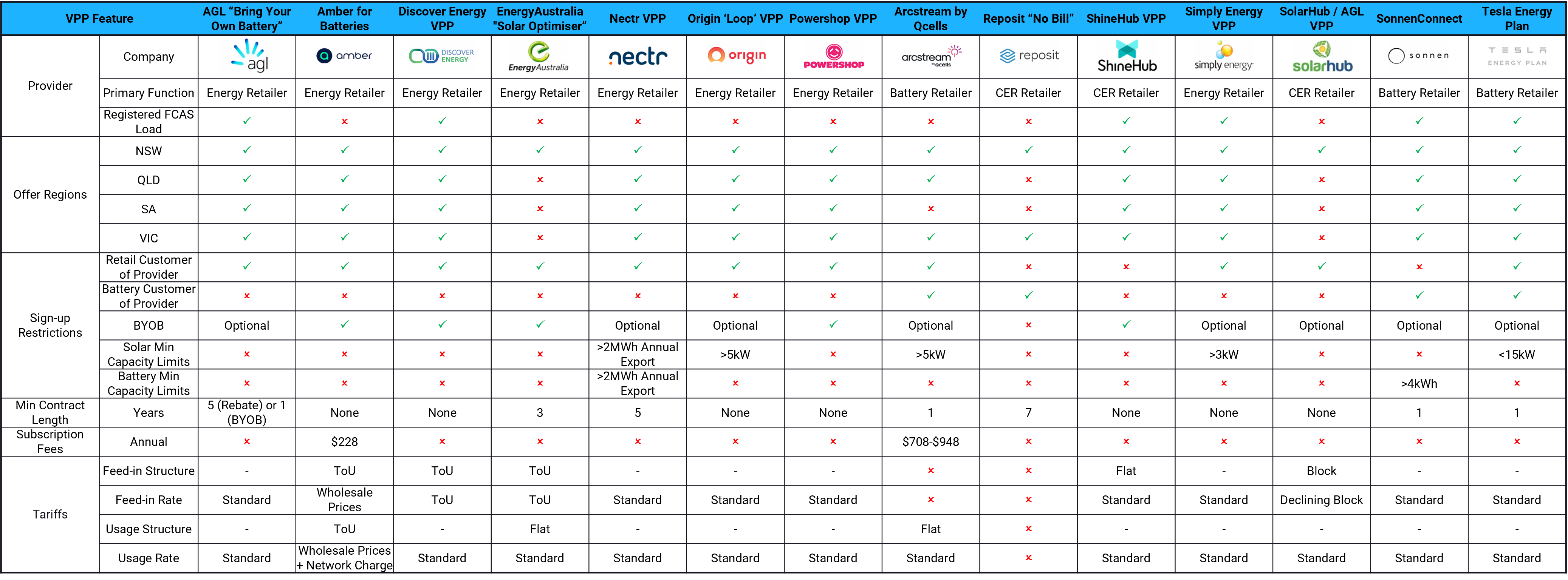

Currently, energy retails, battery manufacturers and 3rd party operators across Australia are setting up VPPs to offer better than retail bill savings outcomes for customers. There is currently a wide variation in offerings in the VPP space as aggregated in Table 2 below. Key terms to note are eligible batteries, number of hours, lock-in periods and level of incentive.

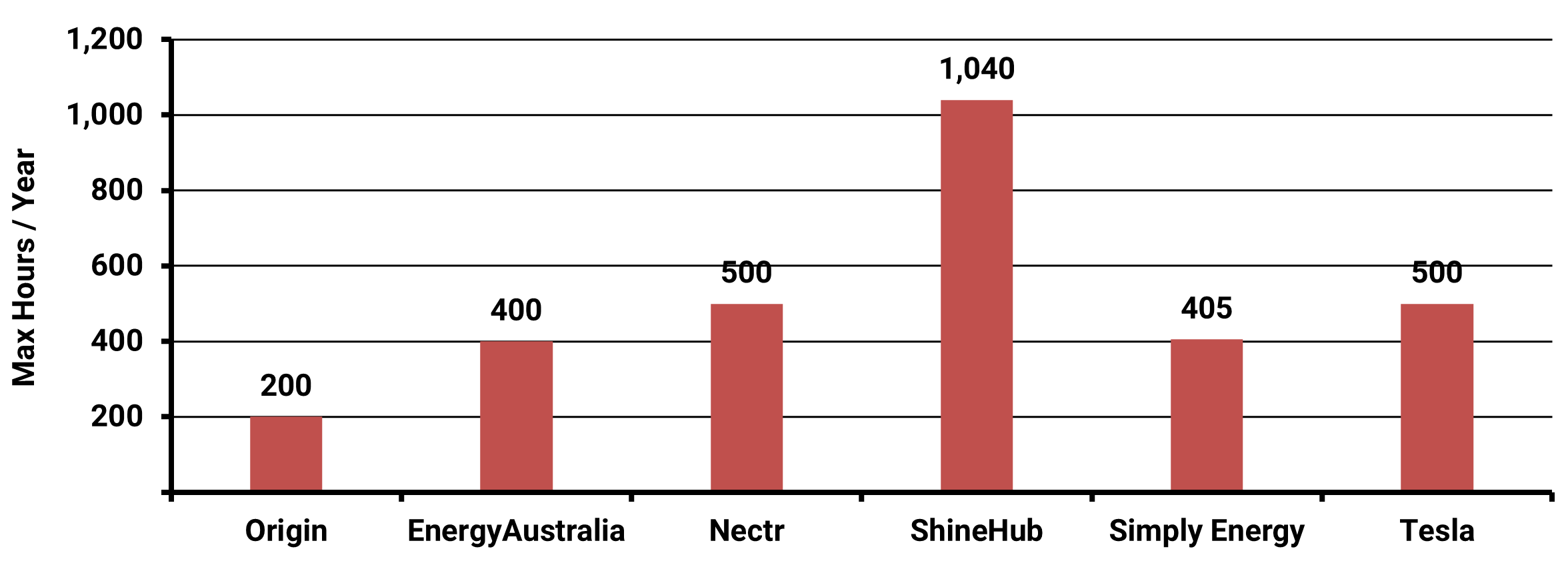

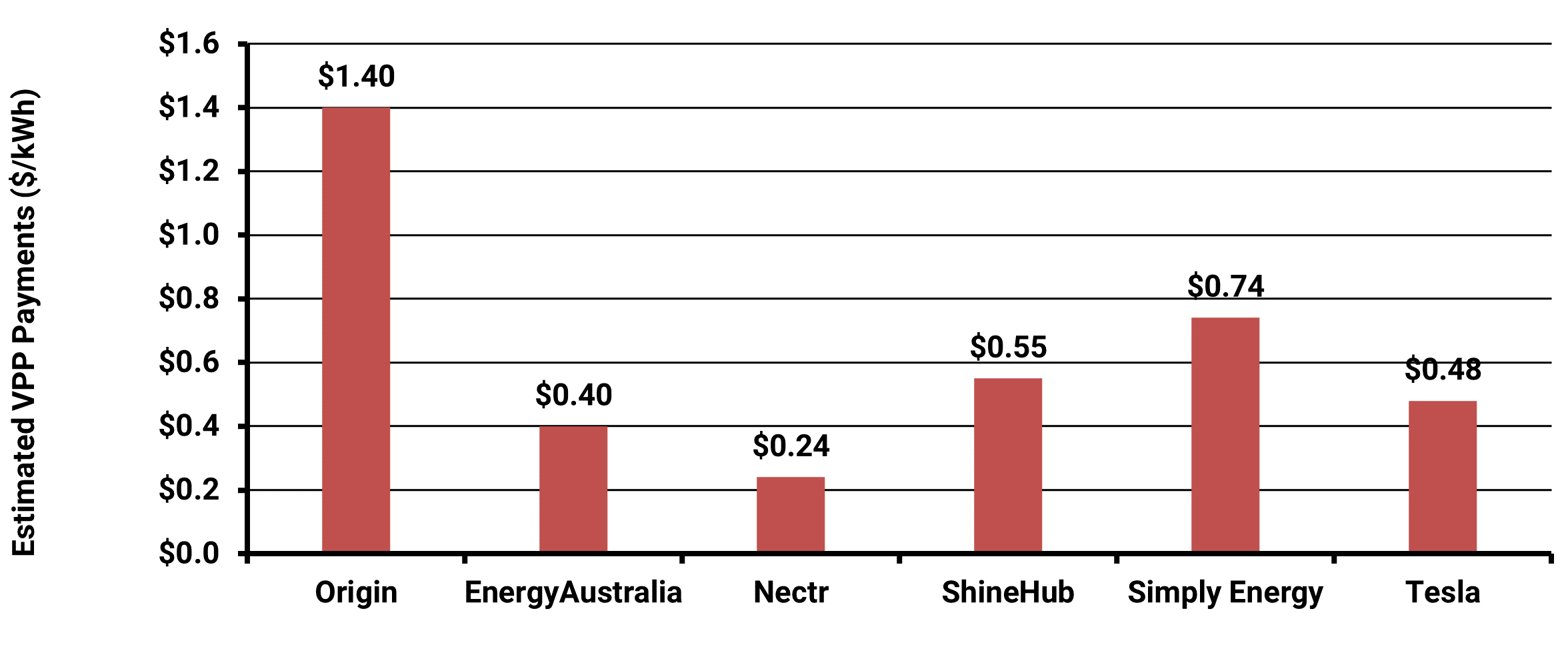

Various Australian VPPs are adopting diverse stances regarding key parameters (Figure 8) such as hours per year and $/kWh rates. The number of hours per year is indicative of the VPP operator’s perspective on the optimal level deemed for assuming control.

Opting for fewer hours allows targeting of higher value periods, with Origin presenting the highest $/kWh rate (Figure 9) for the least amount of operational time. Furthermore, there appears to be no discernible differentiation in the value proposition among batteries, as they are priced as commodities ($/kWh) in this context.

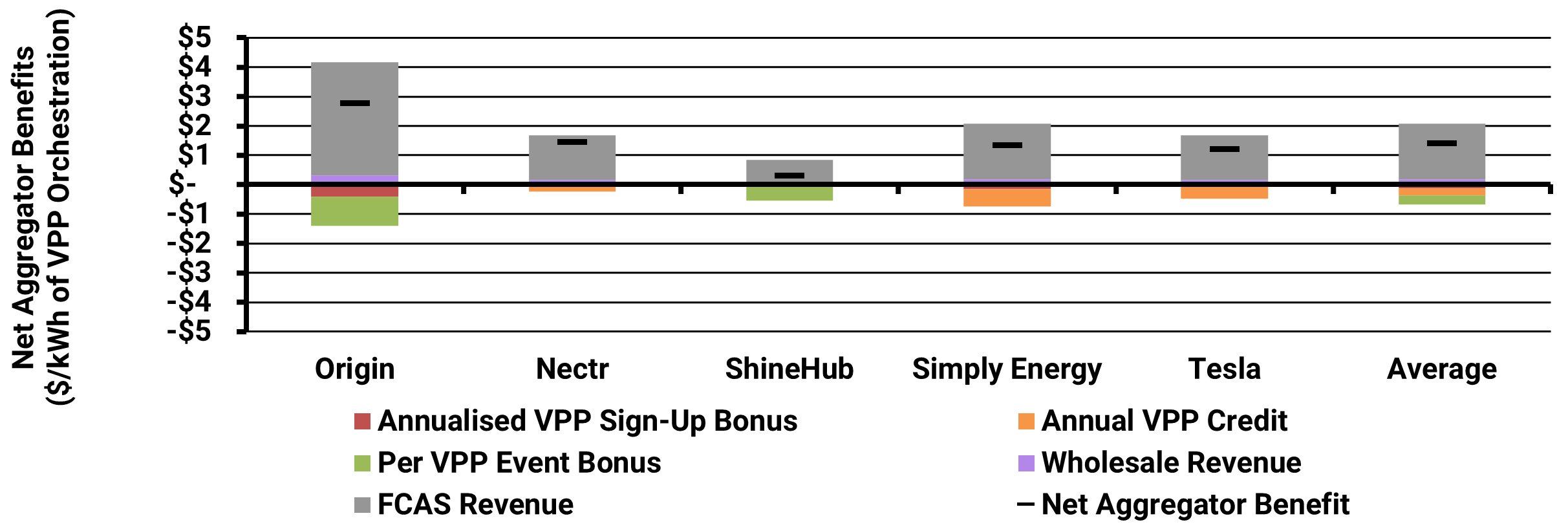

Energeia’s modelling five of the VPP offers; Origin, Nectr, ShineHub, Simple Energy, and Tesla, for a residential customer in South Australia shows these VPP operators seeing up to $3/kWh gross profit in the case of Origin, but on average earning $1/kWh gross profit as shown in Figure 10 below.

value of these hours are doing the best in terms of gross margins, and incentives for customers, which will attract RELATIVELY more customers over time. Energeia notes the above results assume a 100% call on available hours.

Takeaways and Recommendations

The main takeaways from Energeia’s research and analysis along with our associated key recommendations for the future of VPPS are summarised below.

Key Takeaways

- Changes in behind-the-meter devices is changing the mix of products and services consumers need and value

- Feedstock for battery and V2G VPPs substantial to 2050, 20% of the identified storage resources required in the ISP

- VPPs enable operators to unlock industry benefits and share them with consumers

- Trend appears to be away from lock-in contracts and towards bring-your-own-device, though incentive structures are mixed

- Current VPP positioning is wide ranging, with some consistency in the value paid per kWh if not the hours reserved

- VPP terms are key to achieving a profitable VPP operation

- The lack of market transparency makes it impossible to determine VPP market shares, other than from the FCAS market

- Few VPPs are currently tapping into the FCAS market

Key Recommendations

- Set hours where they can deliver 80% of industry benefits using 20% of hours

- Offer a customer bill optimisation service as a value added extra to win more VPP service contracts with consumers

- Ensure system and customer optimization is maximizing value of the resource

- VPPs that can earn more from consumer assets will earn more profits and/or market share

- Players that invest in battery VPPs appear set to gain a significant competitive advantage over those investing in utility scale batteries

For more detailed information regarding the key challenges of analysing and optimising VPPS, best practice methods, and insight into their implementation and implications, please see Energeia’s webinar and associated materials.

For more information or to discuss your specific needs, please request a meeting with our team.

You may also like

Unlocking the Potential of Consumer Energy Resources

The AEMC partnered with Energeia to explore how flexible Consumer Energy Resources (CER), like solar, batteries, electric vehicles, and smart appliances, can reduce costs and

Optimizing DC Fast Charging Tariff Structures

Energy Queensland collaborated with Energeia to address financial barriers in EV charging infrastructure, focusing on high network tariffs and demand charges. The study evaluated alternative

Industrial Decarbonisation: Hard-to-Abate Sectors

Examining hard-to-abate sector’s specific CO2 generation activities, fuel inputs, and viable decarbonization options, including electrification, is required to provide an accurate outlook on this critical