- Webinars

The Balance of Ancillary Services Pricing

Ancillary services, including Frequency Control Ancillary Services (FCAS), are a critical element of the functioning of the National Energy Market (NEM) used to balance generation supply and demand in real-time. Ensuring adequate supply of FCAS services over time helps maintain future electricity system affordability, reliability, and security.

The following sections summarise Energeia’s recent research into ancillary service market trends and drivers in the NEM and how they have evolved over time. Our key findings include:

- Rising levels of intermittent renewable energy are increasing the potential rate of change in demand for FCAS, but this increase is not yet evident in the data

- Exiting of traditional sources of FCAS and the recent rise in virtual power plants (VPPs)and grid-scale batteries has changed the supply side landscape

- Pricing has to date been driven by the system’s single largest contingencies, i.e. interconnectors, and not energy prices or total system demand

- Longer-term, our research and analysis has found that there may be a gap in the supply of FCAS based on work from other jurisdictions, which could lead to future price spikes

FCAS Price Trends

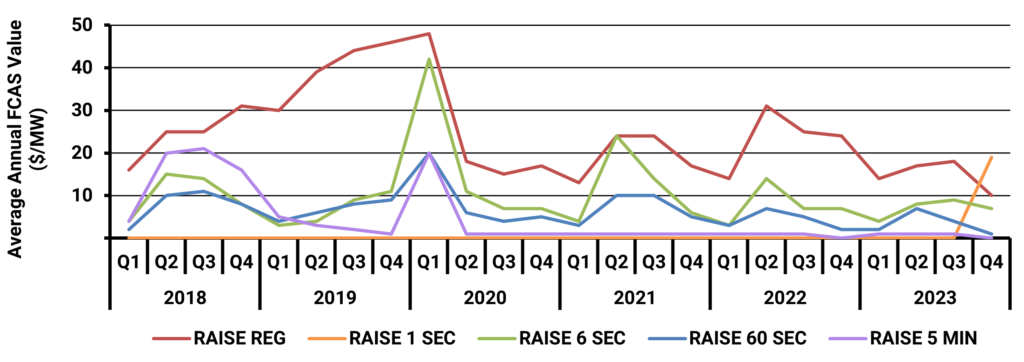

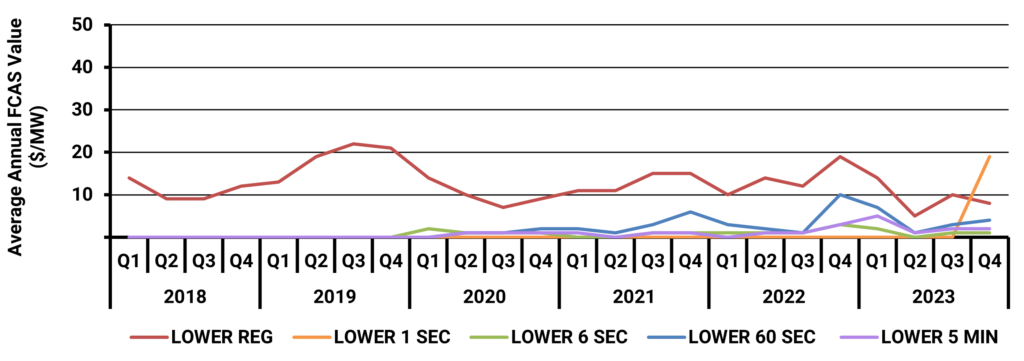

Ancillary service prices, especially for , have persistently spiked in Q1 or Q2, as shown in Figure 1 & 2 below. This is despite FCAS being a relatively small market and therefore easily saturated, as well as entry by several new sources of supply including grid-scale batteries, VPPs and demand response aggregators.

The FCAS raise and lower 1-second markets were added in mid-October 2023, hence pricing is likely to evolve as they become more established markets. It is worth noting that raise prices are typically higher than lower prices, as raise requires generation capacity reserves and demand response is not as easily able to participate.

FCAS prices have been volatile and were particularly susceptible to interconnector outages, which are currently the largest contingency in the market. Some price spikes observed in the above charts correlate to interconnector events including the 2020 islanding of South Australia in Q1, and the Queensland-New South Wales interconnection separation and constraints in mid-to-late 2021.

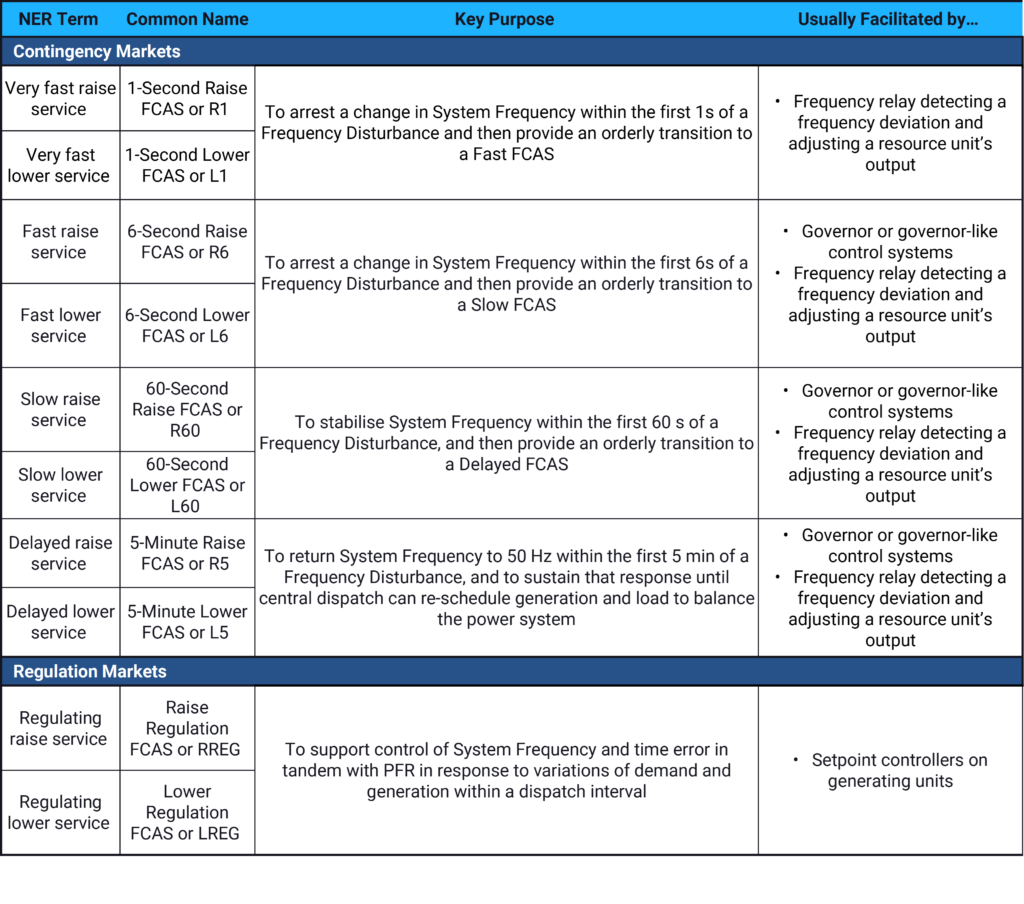

FCAS Types

FCAS services are split into 10 distinct markets. These include 8 contingency and 2 regulation markets, summarised in Table 1 below.

Each contingency market is designed to handle changes in frequency due to sudden, unplanned changes in demand or supply in a ‘relay race style’ whereby each service, when overlayed, acts as a complete transition from one state to the target/ideal state. The regulation service is provided on an ongoing basis utilising setpoint controllers.

Other services including network support and control (NSCAS) and system restart (SRAS) are also provided in the NEM; however, these services are functionally different from the FCAS markets and typically sourced on a contract basis.

FCAS Price Drivers

A topical question in the energy market is: what drives FCAS prices, and how will this persist into the future?

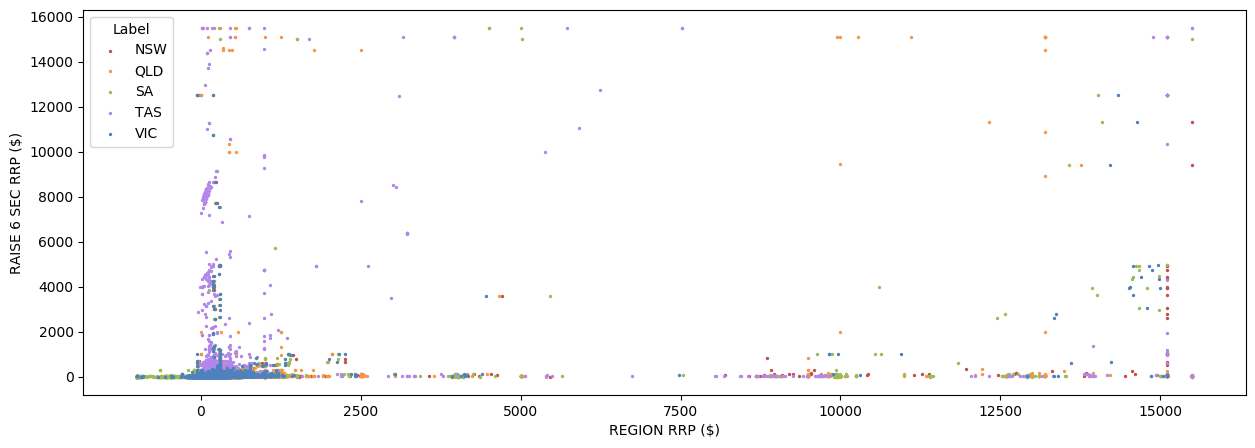

Energeia’s investigation into drivers of FCAS prices analysed the role of energy market prices, or regional reference prices (RRPs), and energy market demand, as well as the demand and supply of FCAS services.

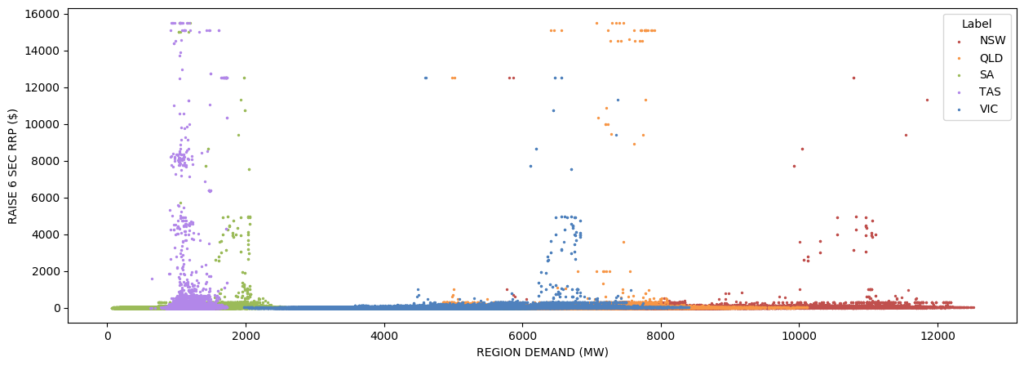

Figure 3 below provides a visualisation of the relationship between historical 6-second raise FCAS and wholesale energy prices. If the dots were clustered in a line from the bottom left to the top right corners, it would indicate a strong, positive relationship, but it does not.

When plotting the correlation factor between total system demand and 6-second FCAS price, no consistent trends in correlation factors are observed, with proportionally higher correlation rates occurring in a range of high and lower-demand bins. This is shown in Figure 4 below.

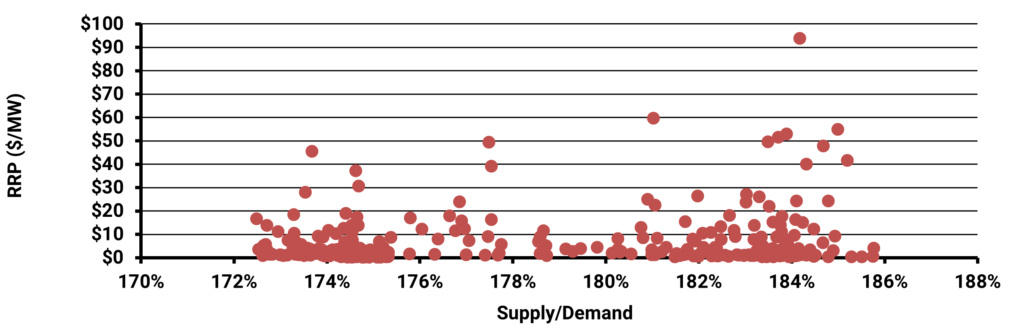

Figures 5 below provides a visualization of the relationship between average 6-Second raise prices and the supply and demand balance in 2023. Again, it seems that demand and supply balance is not a strong indicator of average hourly FCAS pricing by month.

Overall, our research and analysis of current FCAS price drivers has found that neither demand level, RRP level nor demand and supply level, at least on an average basis, is a strong driver of FCAS prices – however this might be about to change.

Listen or click through at your own pace

FCAS Fundamentals

FCAS exist to provide AEMO with operational reserves in case of unplanned variations in demand and supply to keep demand and supply of electricity in balance in real time. Therefore, changes that increase unplanned variation should increase demand for FCAS, and where the increase , an increase in prices as more expensive resources are needed.

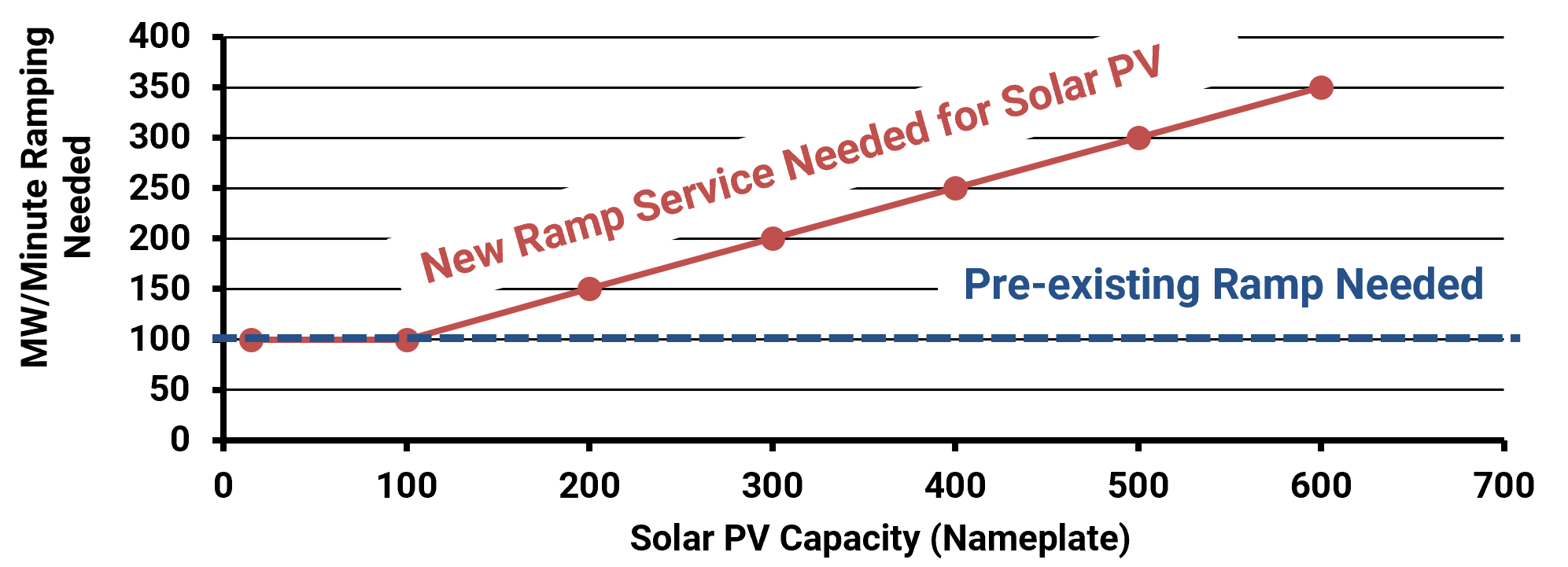

Energeia’s analysis found that an increase in intermittent resources such as solar PV or wind is likely to drive demand for FCAS. This is because solar PV output can rapidly rise and fall due to cloud cover, while wind resources can experience the same fluctuations due to changes in weather. The magnitude of such events, and the FCAS provision needed to account for these, is a function of the installed capacity of intermittent generation and demand.

Figure 6 shows indicative ramping service needed per MW of solar PV capacity installed, based on our analysis of 1 minute solar PV data. Importantly, this effect can be hidden by existing noise, until it becomes the largest driver of demand for fast frequency response (FFR) a term more typically used in Europe and the US. This may explain why NEM FCAS prices have not correlated with solar PV capacity to date and have instead largely been driven by interconnector faults.

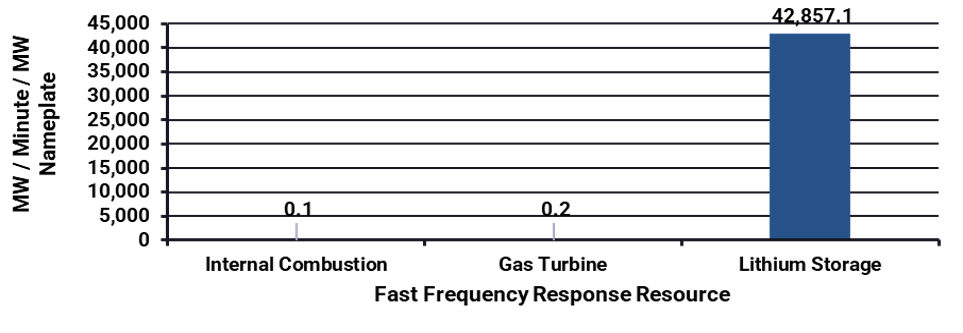

Energeia’s analysis also identified significant differences in ramping rates between existing sources of FCAS supply. This impacts the ability of various technologies to provide the FCAS needed to keep supply and demand in balance. Resource FCAS and FFR capacity primarily depend on a resource’s rate of change or ramp rate.

As shown in Figure 7, battery storage has a significantly higher ramp rate compared to . While traditional resources can’t change output as quickly as battery storage, the kinetic energy in the rotating machine can deliver limited amounts of nearly instantaneous response, which is also known as system inertia.

Together, Energeia’s analyses suggest that once they exceed interconnectors as the key driver of demand for FCAS, there is likely to be a growing demand for FCAS over time commensurate with the level of intermittent resources. The supply of FCAS is likely to be dominated by storage, given its responsiveness and relative cost competitiveness.

Energeia ‘s findings were supported by overseas analyses; however, it is early days in many markets in terms of the percentage of intermittent resources.

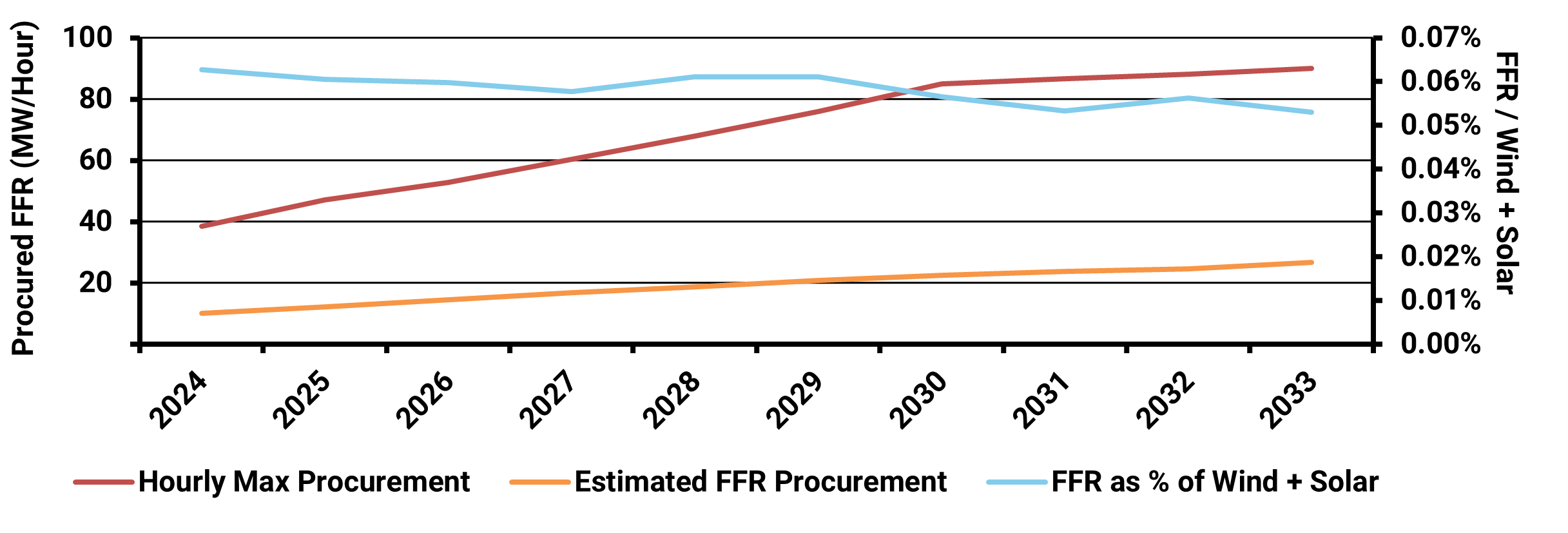

A case study from Energinet provides an outlook for equivalent ancillary services to 2040 in Denmark, shown in Figure 8 below. The analysis shows FFR procurement increasing with solar PV penetration before plateauing in 2030.

The Outlook for FCAS in Australia

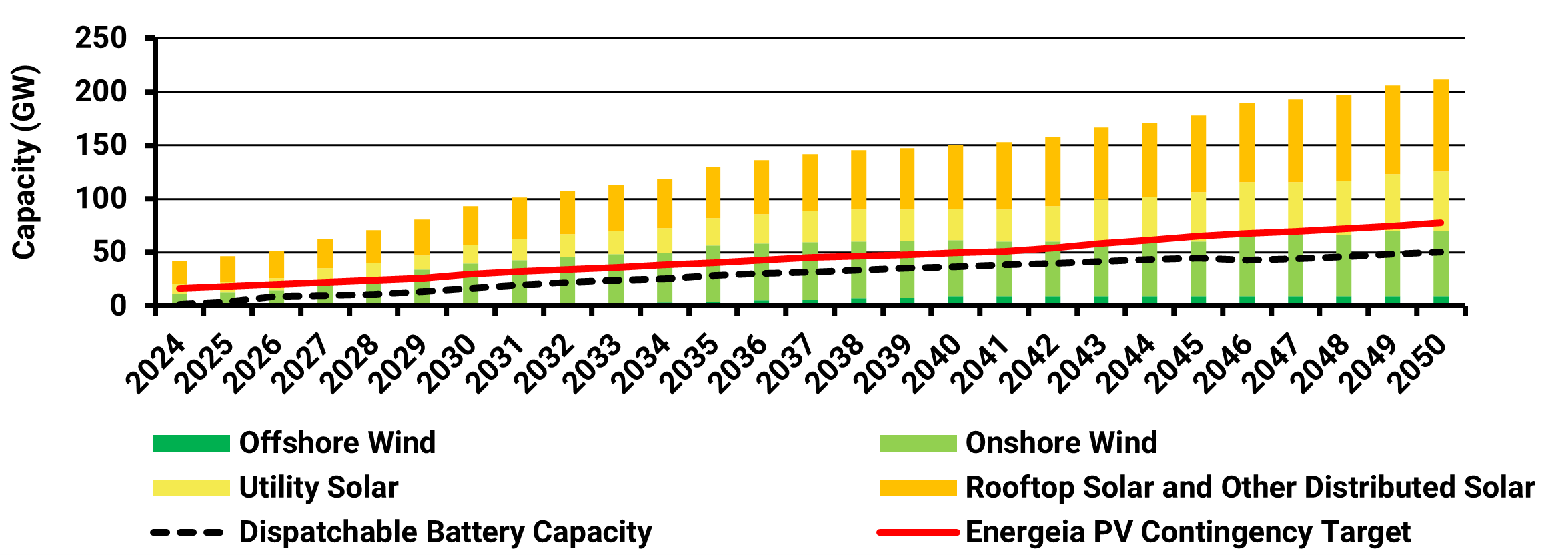

Based on our research and analysis, Energeia estimated an indicative demand for FCAS over time based on the forecast volumes of solar PV and wind generation capacity published in AEMO’s ISP under the Step Change scenario used for system planning.

Figure 9 below shows dispatchable battery capacity vs. an estimate of ramping capacity requirements to keep the system in balance. Energeia estimated the amount of ramping capacity needed based on the ratio of fast, 60-second or faster response capacity to intermittent resources independently estimated by Energeia, i.e. 55%.

The analysis shows that the currently forecast ISP volumes of battery uptake may be insufficient to meet FCAS needs over time at the moment, with the target volume approximately double the forecast dispatchable battery capacity.

It is important to note that the above analysis shows current levels of dispatchable battery capacity are also short of the estimated need; however, the level of FCAS already required by the single largest contingency in the market, i.e. interconnectors, may be the higher requirement. Once renewable capacity becomes the single largest contingency, Energeia’s analysis, and that of Energinet, suggests that it could become the key driver of FCAS demand.

Takeaways and Recommendations

The main takeaways from Energeia’s research and analysis, and our associated key recommendations for the future of FCAS are summarised below.

Key Takeaways:

- FCAS ensure the secure, reliable operation of the NEM by providing a series of interwoven, fast response services to keep demand and supply in balance at all times

- FCAS prices are currently driven by interconnector events, higher for raise than lower and higher for faster services, with raise regulation the highest value service

- Increasing intermittent solar PV and wind resources will require an increasing amount of FCAS, once they become the single largest contingency

- Overseas market operators are also forecasting solar PV and wind to be the key driver of demand for FCAS

- AEMO’s ISP may not include sufficient battery storage to meet the forecast penetration of intermittent renewable energy

Key Recommendations:

- There may be additional price spikes in the FCAS market as solar PV and wind capacity becomes the single largest driver of demand for FCAS while batteries lag behind

- Additional work may be needed to ensure there is sufficient ramping capacity in the NEM to keep demand and supply in balance at all times

For more detailed information regarding the key challenges of analysing and optimising VPPS, best practice methods, and insight into their implementation and implications, please see Energeia’s webinar and associated materials.

For more information or to discuss your specific needs, please request a meeting with our team.

You may also like

Unlocking the Potential of Consumer Energy Resources

The AEMC partnered with Energeia to explore how flexible Consumer Energy Resources (CER), like solar, batteries, electric vehicles, and smart appliances, can reduce costs and

Optimizing DC Fast Charging Tariff Structures

Energy Queensland collaborated with Energeia to address financial barriers in EV charging infrastructure, focusing on high network tariffs and demand charges. The study evaluated alternative

Industrial Decarbonisation: Hard-to-Abate Sectors

Examining hard-to-abate sector’s specific CO2 generation activities, fuel inputs, and viable decarbonization options, including electrification, is required to provide an accurate outlook on this critical