- Webinars

Industrial Decarbonisation: Hard-to-Abate Sectors

Global, Federal, and State Emissions Targets

Hard-to-abate emissions continue to be forecast as minimally changing to 2050 across various sectors in Australia, including transportation and industrial sectors. Transportation and industrial processes are forecast to account for which account for over a third of total baseline emissions by 2040, as shown in Figure 1. These industries rely on energy-intensive processes that are difficult to decarbonise, such as high-temperature furnaces, heavy machinery, and chemical reactions.

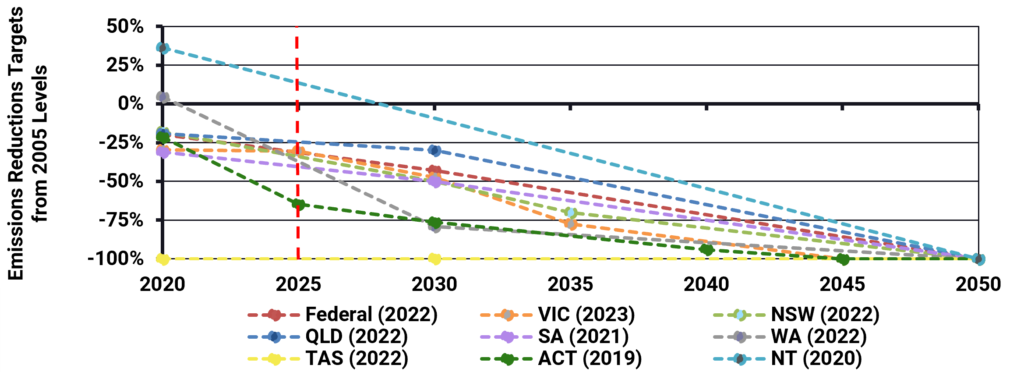

Figure 2 below shows the emissions targets federally and by state, which show the level of reduction needed vs. the forecast emissions over time shown in Figure 1. Understanding the factors driving industrial emissions, and the unique abatement options of these sectors, including their potential for energy efficiency, fuel switching or post-emissions abatement is crucial for utilities, policymakers, and industry leaders.

The following sections summarise Energeia’s latest research into hard-to-abate industrial emissions, including the factors contributing to their persistence, strategies for improving energy efficiency and reducing emissions, and opportunities for implementing carbon capture and alternative technologies. These sections offer actionable insights and recommendations designed to help stakeholders address the complexities of decarbonising hard-to-abate industries while maintaining economic competitiveness.

Australian Industrial Energy Consumption

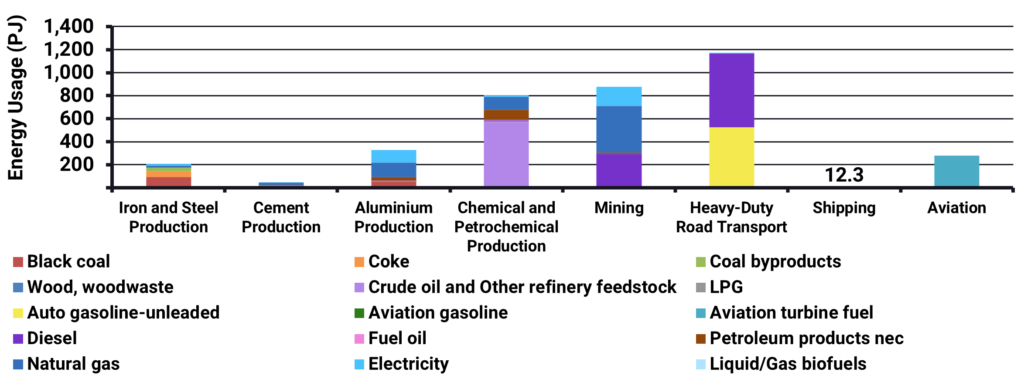

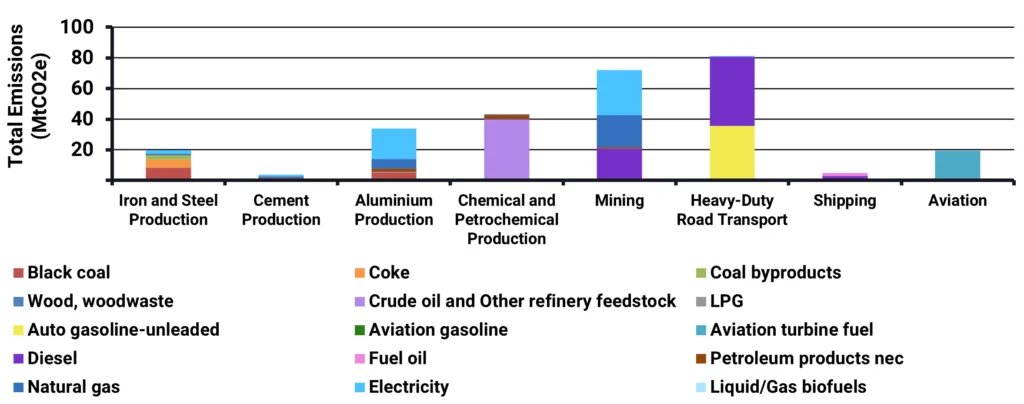

Industrial energy usage is shown below in Figure 3 by industrial segment and fuel type along with corresponding emissions. Heavy duty transport, mining, chemical and petrochemical production, and aluminium production have the highest total energy use.

These same sectors generate more than double the level of CO2 than most other sectors. This investigation into hard-to-abate sectors has focused on a subset of these, where more than electrification is likely to be required for a range of reasons.

Which Sectors and Processes are Hard to Abate

Hard-to-abate processes occur in a number of different sectors. Each of the hard-to-abate end uses typically involves one of the following:

- Processes with CO2 as a feedstock

- Processes with CO2 as a byproduct

- Processes requiring a light-weight fuel, typically aviation

- Processes requiring a dense fuel, typically shipping

- Processes at very high temperatures, which have historically been difficult and/or costly to achieve with electricity

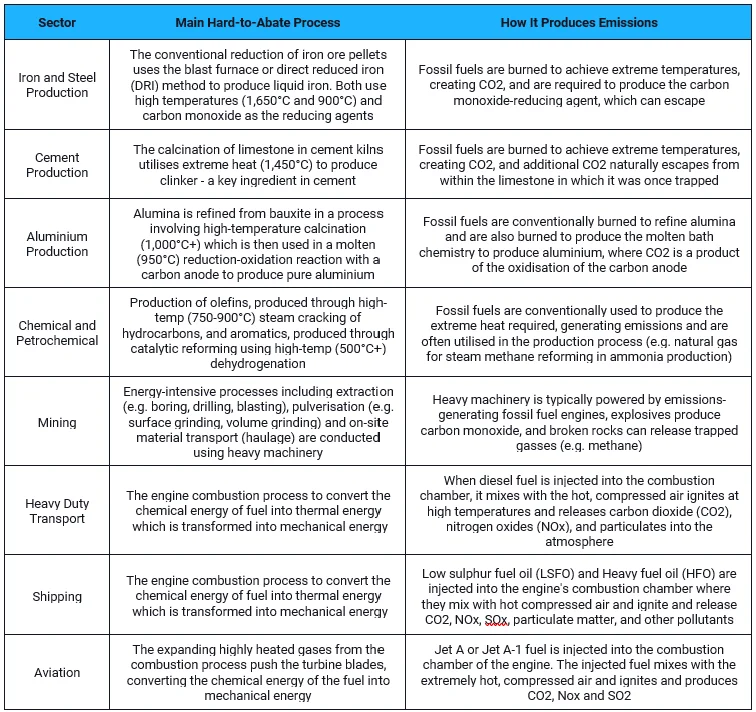

Table 1 below summarises the sectors and their corresponding processes which classify them as hard to abate.

Solutions for Abatement

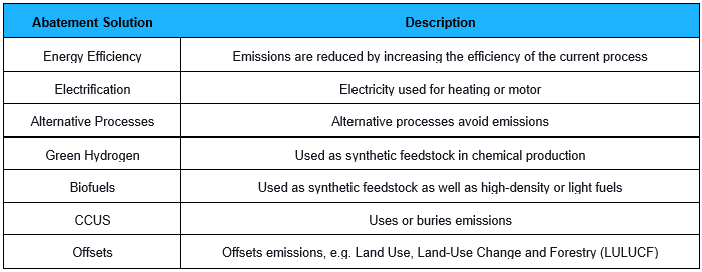

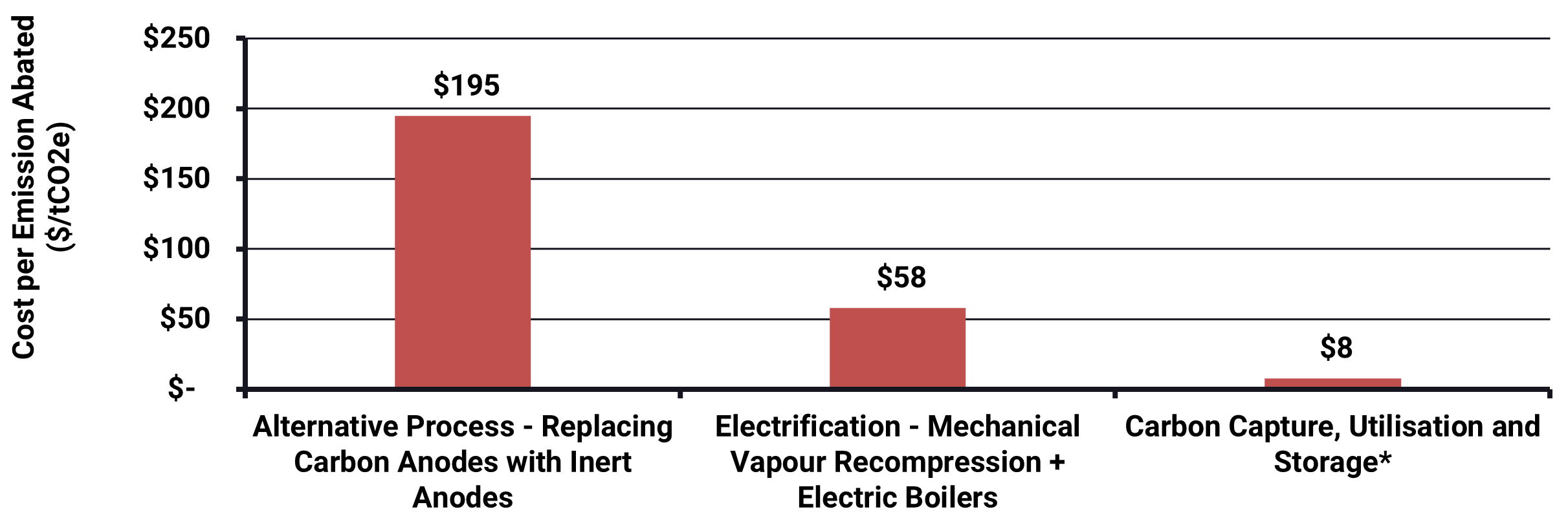

The following table summarises the different solutions which aim to abate carbon emissions from processes.

Global, Federal, and State Targets

Different hard-to-abate sectors benefit from different solutions for emissions abatement. Mixed solutions may be required for different processes within the same industry. Energy efficiency, and alternative processes may not abate all emissions.

Listen or click through at your own pace

Cost to Abate

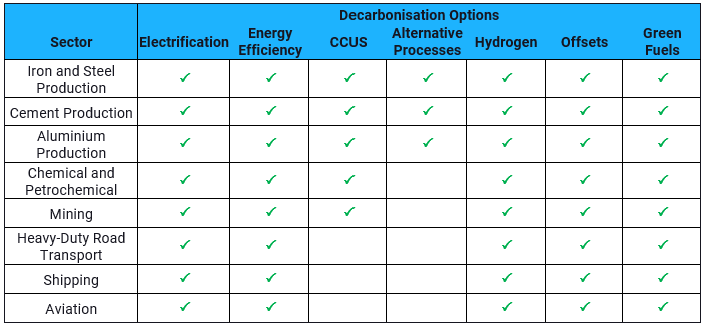

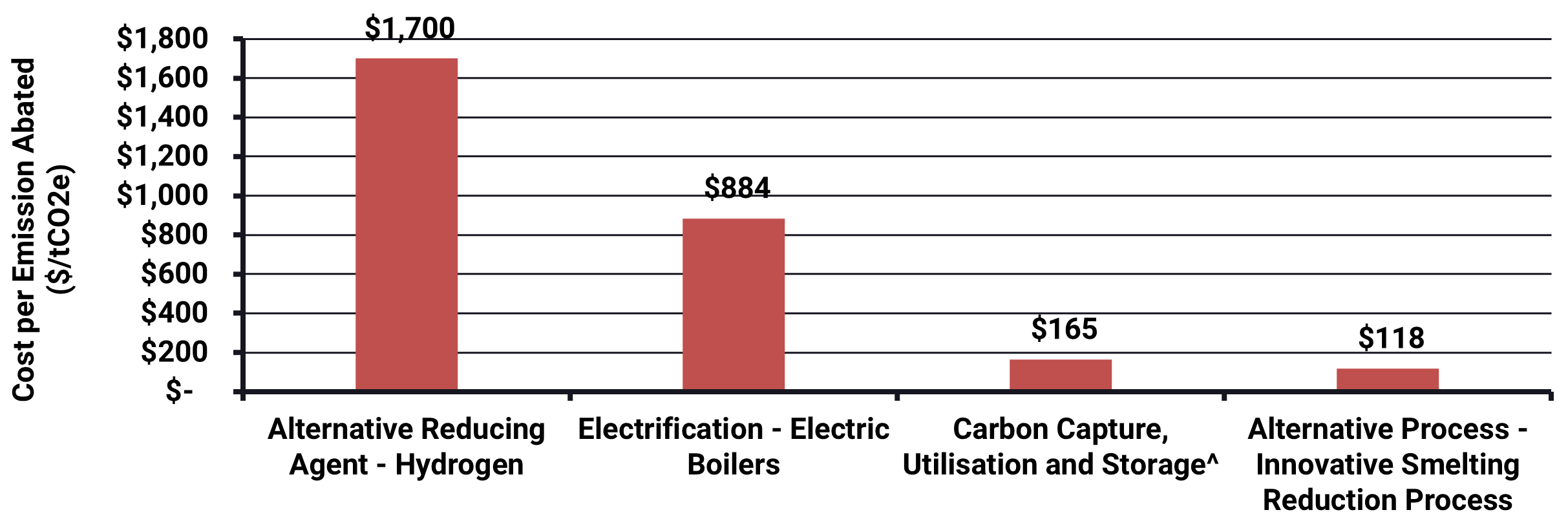

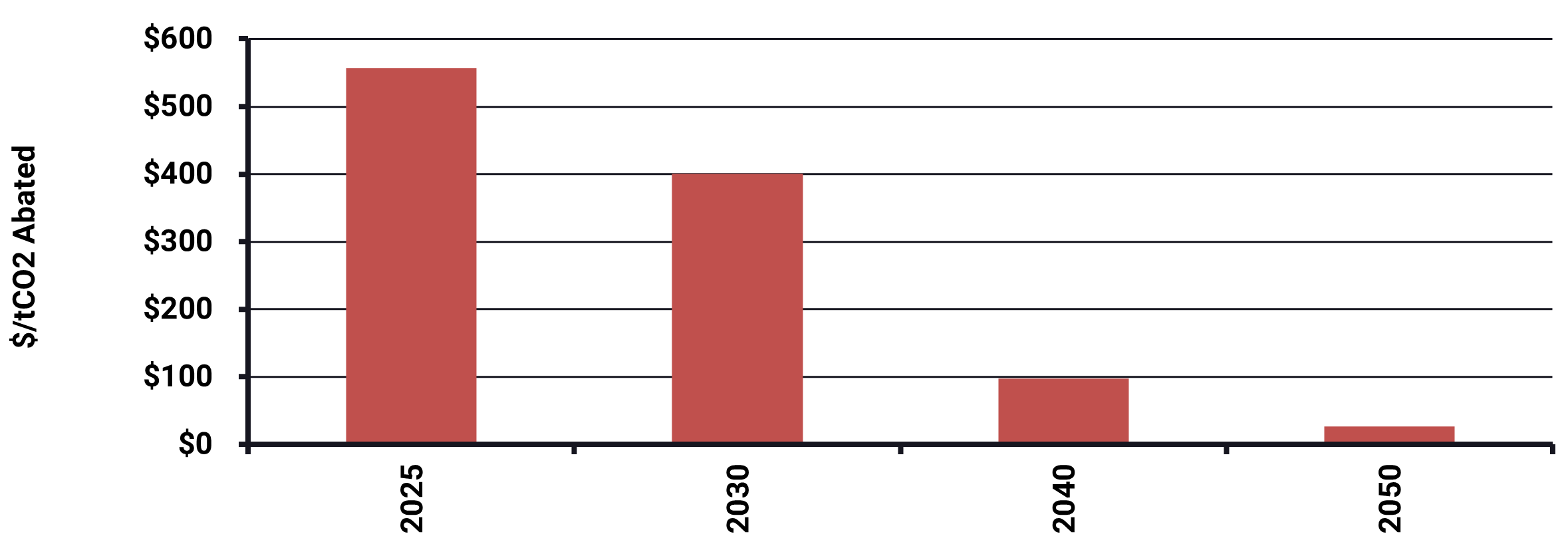

Energeia researched and modelled the cost per metric ton of CO2 abatement to decarbonise different sectors. Energeia’s analysis shows a wide range of costs among potential decarbonisation pathways for hard-to-abate industry sectors.

Industrial Sector

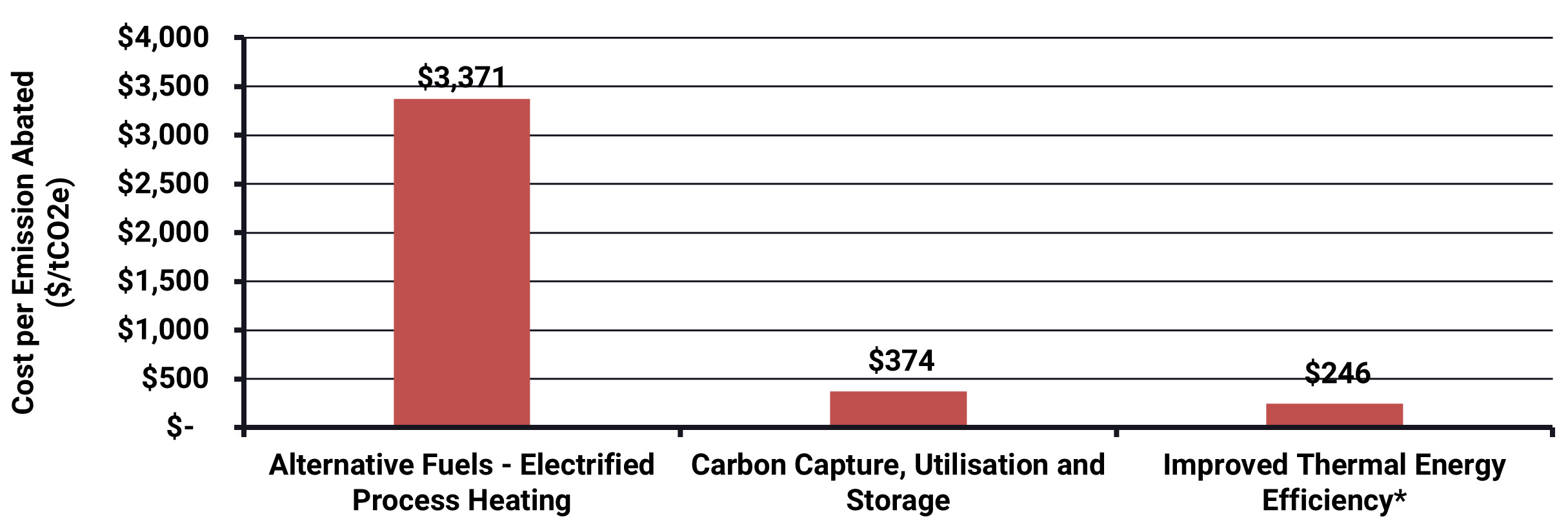

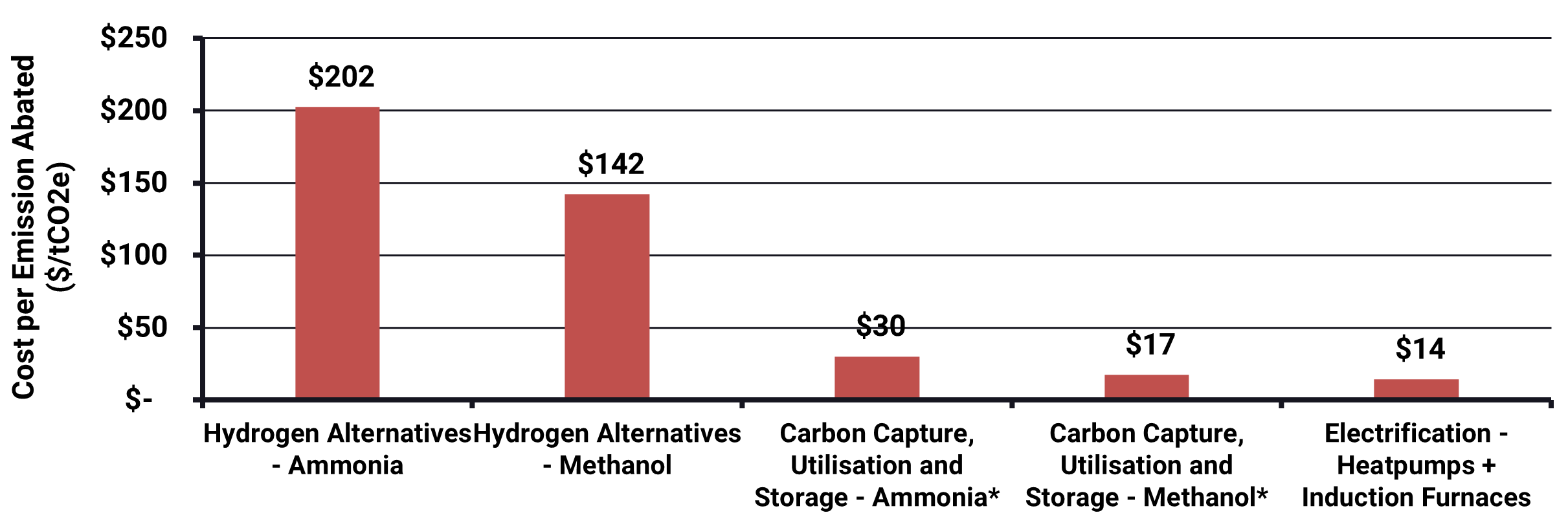

Figure 5 below shows the outcomes of the modelling for iron and steel production. Key iron and steel abatement options can be extremely expensive at over $1,700/CO2e, with carbon capture, utilisation and storage (CCUS) or offsets potentially being more cost-effective solution.

For cement production, costs rise compared to aluminium, and improved thermal efficiency is the lowest cost solution to abatement, however, this solution is not capable of abating all emissions. Note that the CCUS costs are vastly different between steel and iron vs. cement, mainly due to the difference in capture and utilisation costs.

Importantly, many of the key solutions identified here will not be able to reduce 100% of sector emissions, instead requiring a portfolio approach and/or offsets.

Transport Sector

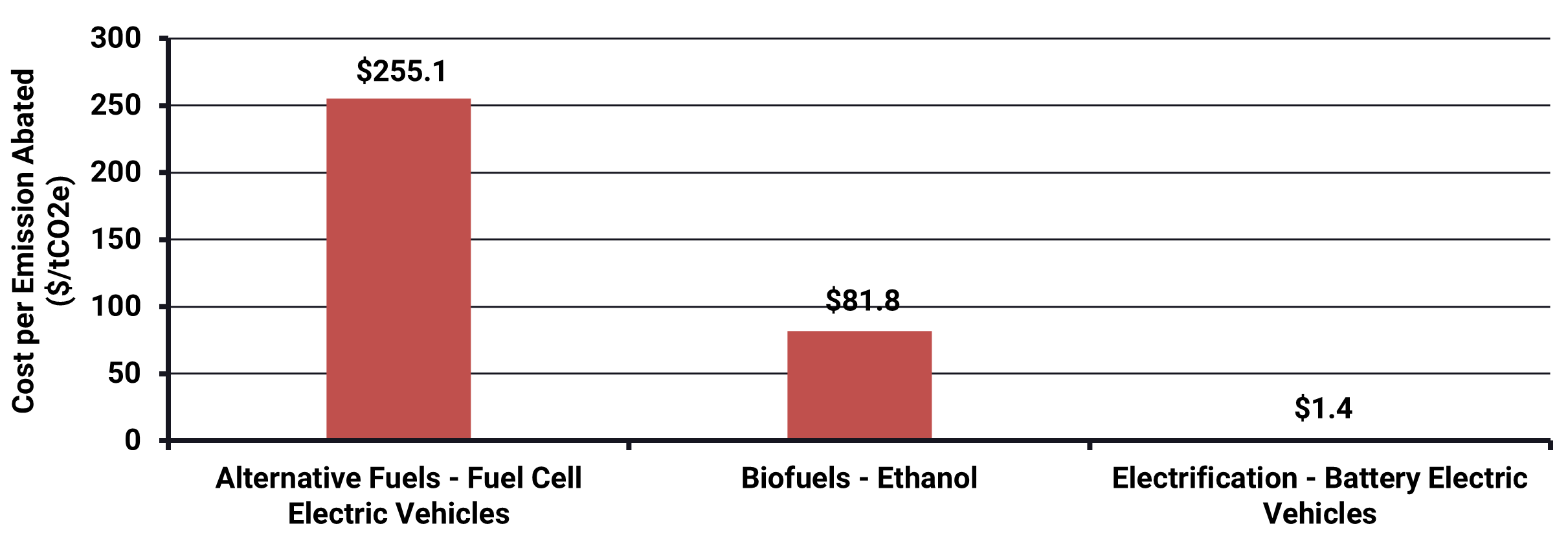

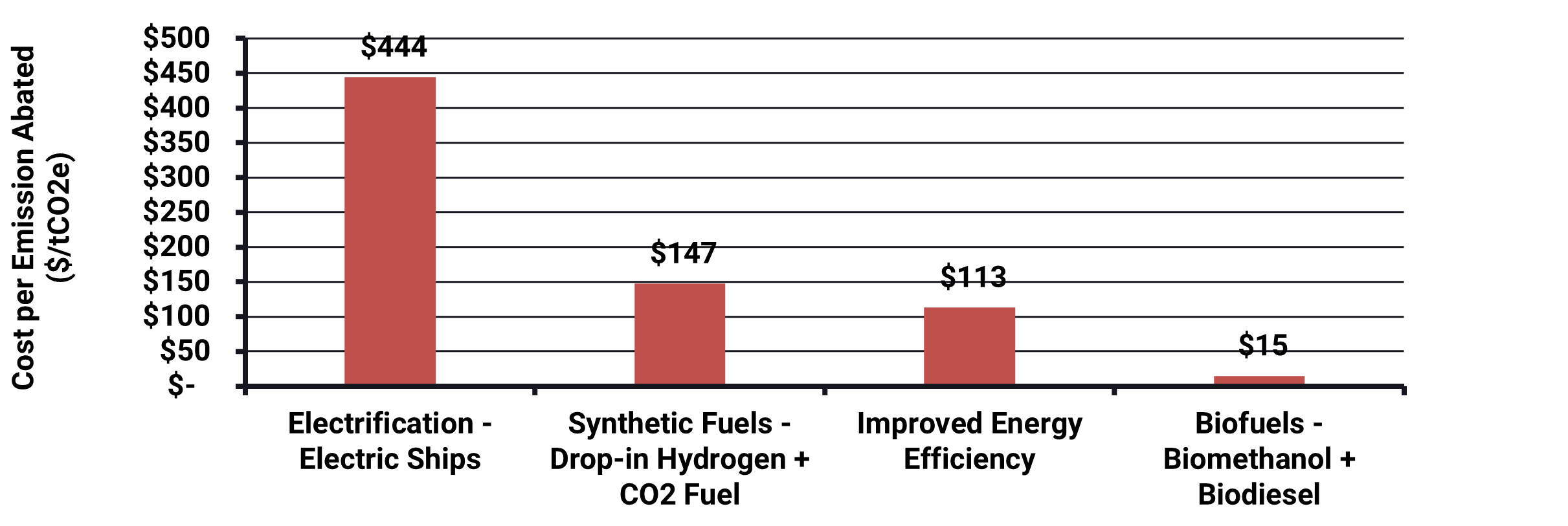

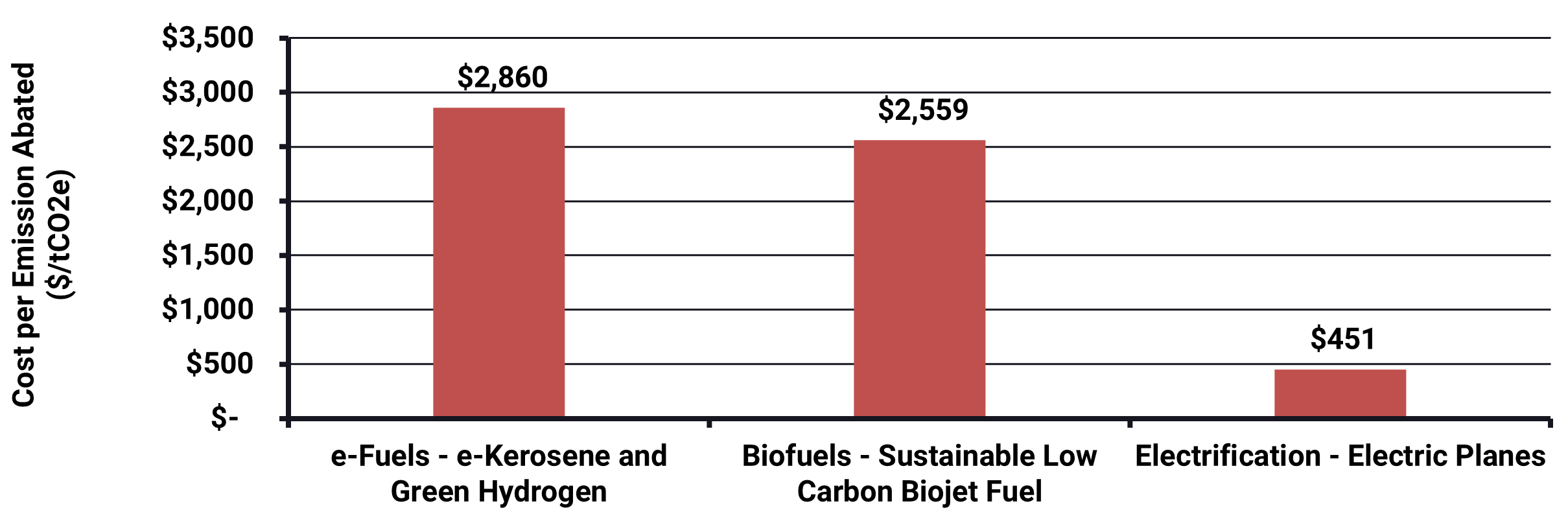

Transport remains one of the largest emitting sectors that many countries are looking to decarbonise moving forward. Figures 9 – 11 show the cost to abate emissions for heavy-duty road transport, shipping and aviation.

For heavy-duty road transport, electrification is the least cost solution for short-distance applications, however, current battery electric technology is constrained by energy density. Biofuels provide a cost-effective solution for reducing emissions in existing fleets across all sectors despite their lower energy density. Alternative fuels (ie. hydrogen) offer a potential technical solution to the energy density challenge for vehicle range, however, face infrastructure and scalability issues due to the immaturity of the technology. Alternate fuels are also currently modelled to be the highest-cost solution.

Future Directions

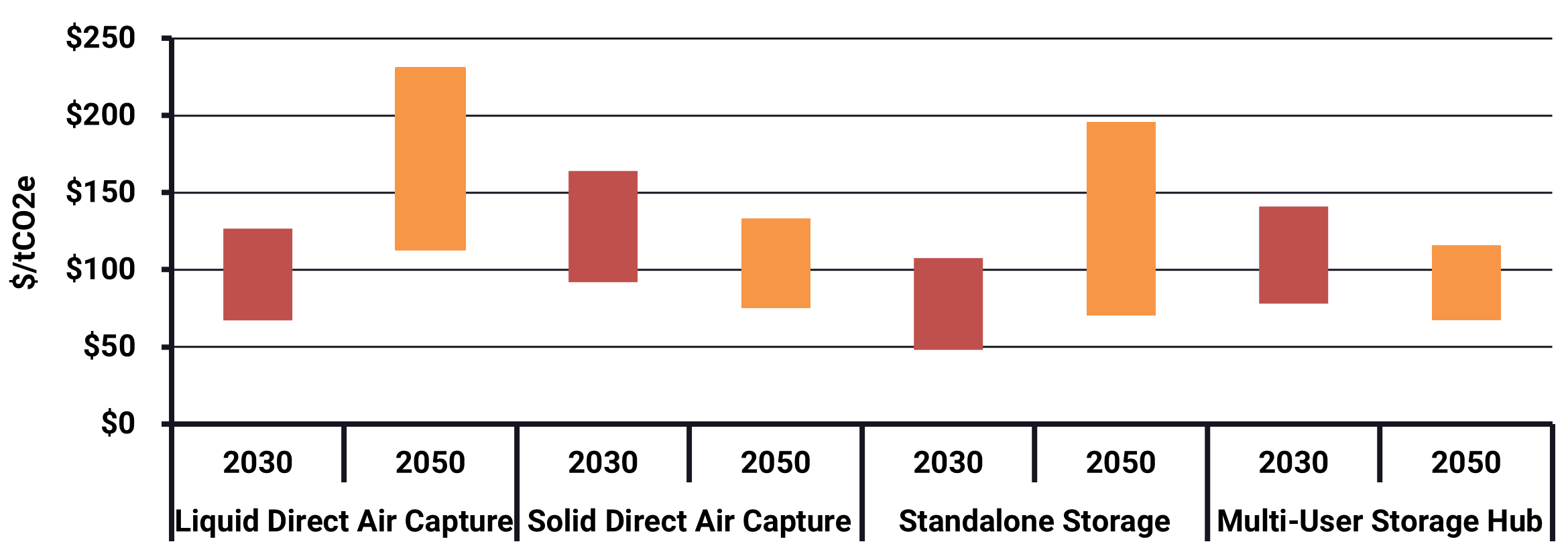

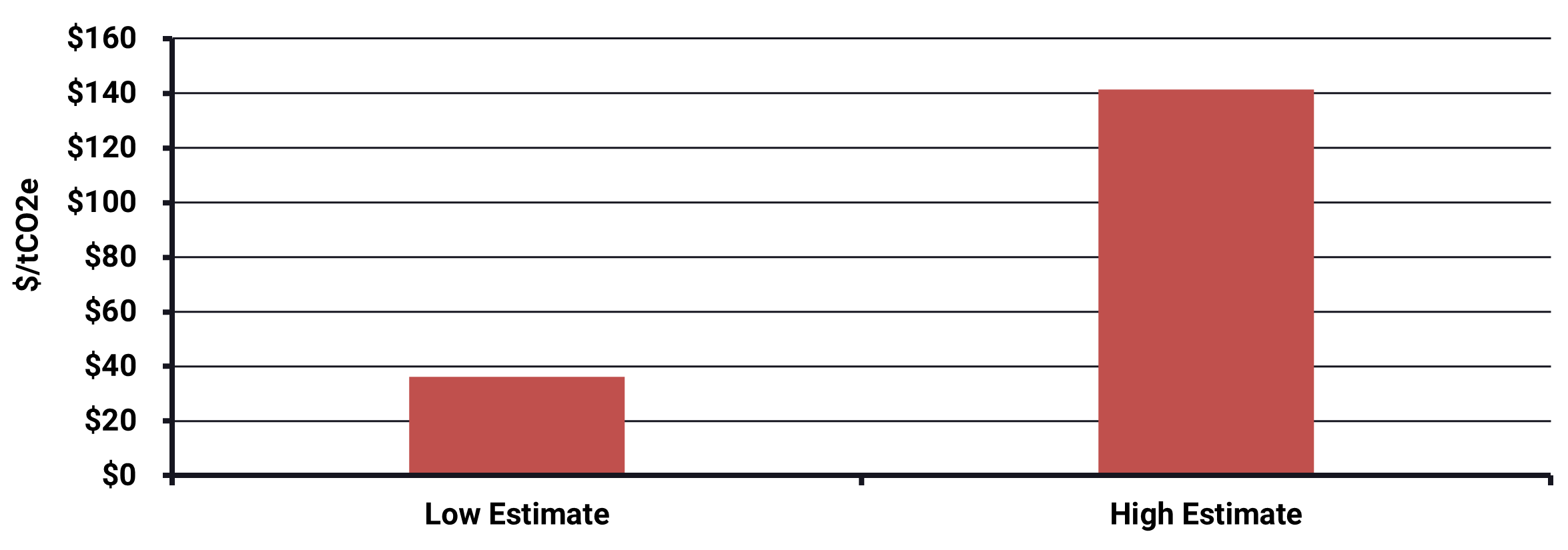

Uncertainty in costs additionally drives the complexity of decarbonisation of hard-to-abate sectors. Figures 12 and 13 below show the range in estimates of solution cost forecasts for carbon capture and storage, and LULUCF, which both are additional costs to established carbon emitting technologies to make them carbon neutral.

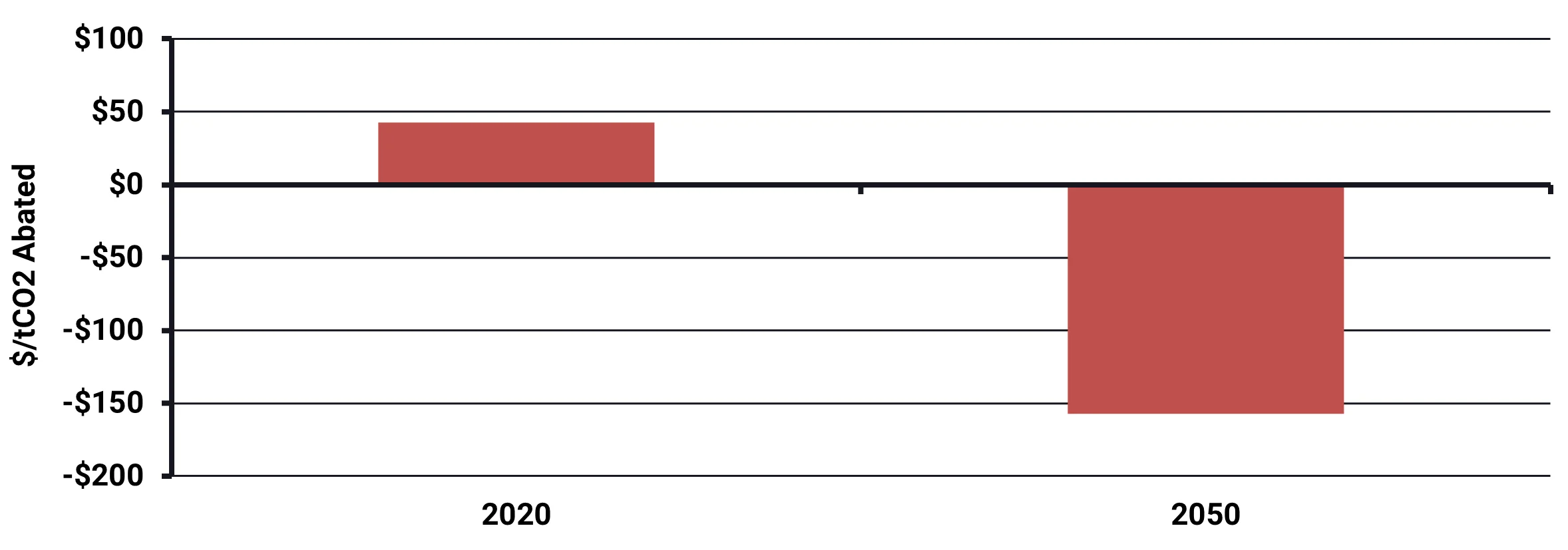

Figure 14 shows that biodiesel is forecast be an economic abatement solution for diesel applications, e.g. heavy transport and mining, between now and 2050. This assumes lifetime scope 1 emissions for biodiesel, which assumes 100% of CO2 emissions are in balance. i.e. net emissions of production and use are 0 tCO2.

Takeaways and Recommendations

Energeia’s key takeaways and recommendations for tackling emissions reductions in hard-to-abate industries (derived from Energeia’s best practice research and innovative analysis) are summarised below.

Key Takeaways:

- Transportation and industrial processes are forecast to account for which account for over a third of total baseline emissions by 2040

- Of these, a large proportion of them are not suited to electrification for a range of reasons

- While specific solutions are being developed in each case, they can be very high-cost

- CCS/CCUS and offsets are general approaches that may be needed to achieve abatement targets

- A key question is how accurate the CCS / CCUS cost estimates are

Key Recommendations:

- Electric high temperature heat technologies are a key solution that will be essential to the transition

- R&D focus will be key to bringing its cost down

- While biofuels are relatively low cost, there are not enough of them to meet all needs

- Green hydrogen will be needed to provide feedstock, and the focus should be on this application

- Much is riding on CCS / CCUS and LULUCF, and additional effort should be focused on them to bring costs down and ensure capacity

For more detailed information regarding the key challenges of analysing and optimising electrification, best practice methods, and insight into their implementation and implications, please see Energeia’s webinar and associated materials.

For more information or to discuss your specific needs, please request a meeting with our team.

You may also like

Bridging the Skills Gap: Workforces for Electrification

Australia’s clean energy transition demands a skilled workforce. Energeia’s analysis reveals urgent needs, strategic solutions, and policy pathways to bridge the electrification skills gap and

Unlocking the Potential of Consumer Energy Resources

The AEMC partnered with Energeia to explore how flexible Consumer Energy Resources (CER), like solar, batteries, electric vehicles, and smart appliances, can reduce costs and

Optimizing DC Fast Charging Tariff Structures

Energy Queensland collaborated with Energeia to address financial barriers in EV charging infrastructure, focusing on high network tariffs and demand charges. The study evaluated alternative